The challenges of shifting, complex, component-based tariffs –– including Section 232 –– caused a major manufacturer to miscalculate and unknowingly overpay and underpay duties. With Altana, the manufacturer completed a post-entry duty audit and identified millions of dollars of refunds. Now, with AI-powered trade compliance workflows, the manufacturer has slashed the amount of time necessary to determine origin, calculate duties, classify products, validate material composition, and more –– enabling accurate trade and tariff calculation before products reach the border to avoid future overpayment and underpayment and achieve consistent landed costs.

Before the Product Network

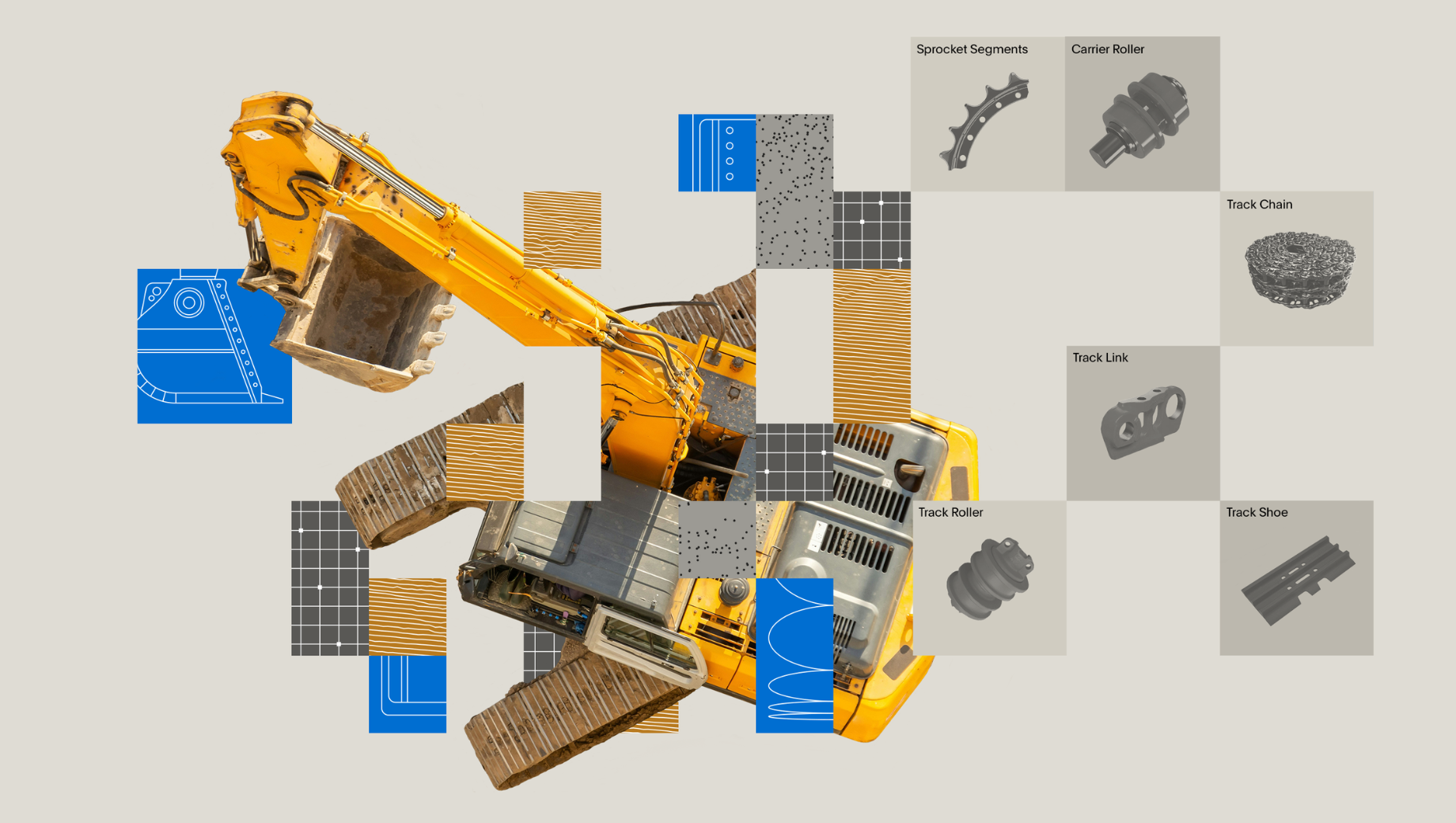

- Struggled to calculate or mitigate complex, component-based Section 232 tariffs and determine material composition in products

- Trade team was swamped by manual processes for origin determination, duty calculation, product classification, material composition validation, and more