The new, complex definition of a Foreign Entity of Concern

The OBBBA, signed into law on July 4, 2025, created two new categories of FEOCs: Specified Foreign Entities (SFEs) and Foreign Influenced Entities (FIEs), adding a long list of criteria under which vehicles would be ineligible for the credit.

SFEs include companies owned by the Chinese military or subject to the Uyghur Forced Labor Prevention Act and any entity under the control of China, Russia, North Korea, or Iran. FIEs include companies over which an SFE holds significant influence, based on ownership stake, ability to appoint officers and directors, and other criteria.

The redefinition of FEOC has major implications for automotive supply chains: Where previously a manufacturer of battery parts would be non-compliant if it were directly controlled by a foreign government, now the OEM purchasing batteries needs to factor in degrees of partial and aggregate ownership of the supplier. A part could be ineligible if its manufacturer is 25% owned by a company linked to the Chinese military.

For auto OEMs, which rely on a vast global supply chain, this is a game-changer. Without absolute certainty that every input and component separately complies with the FEOC restrictions, EVs risk losing the crucial $7,500 tax credit.

The Upstream Challenge: Beyond Tier 1, EV value chains susceptible to hostile foreign entities

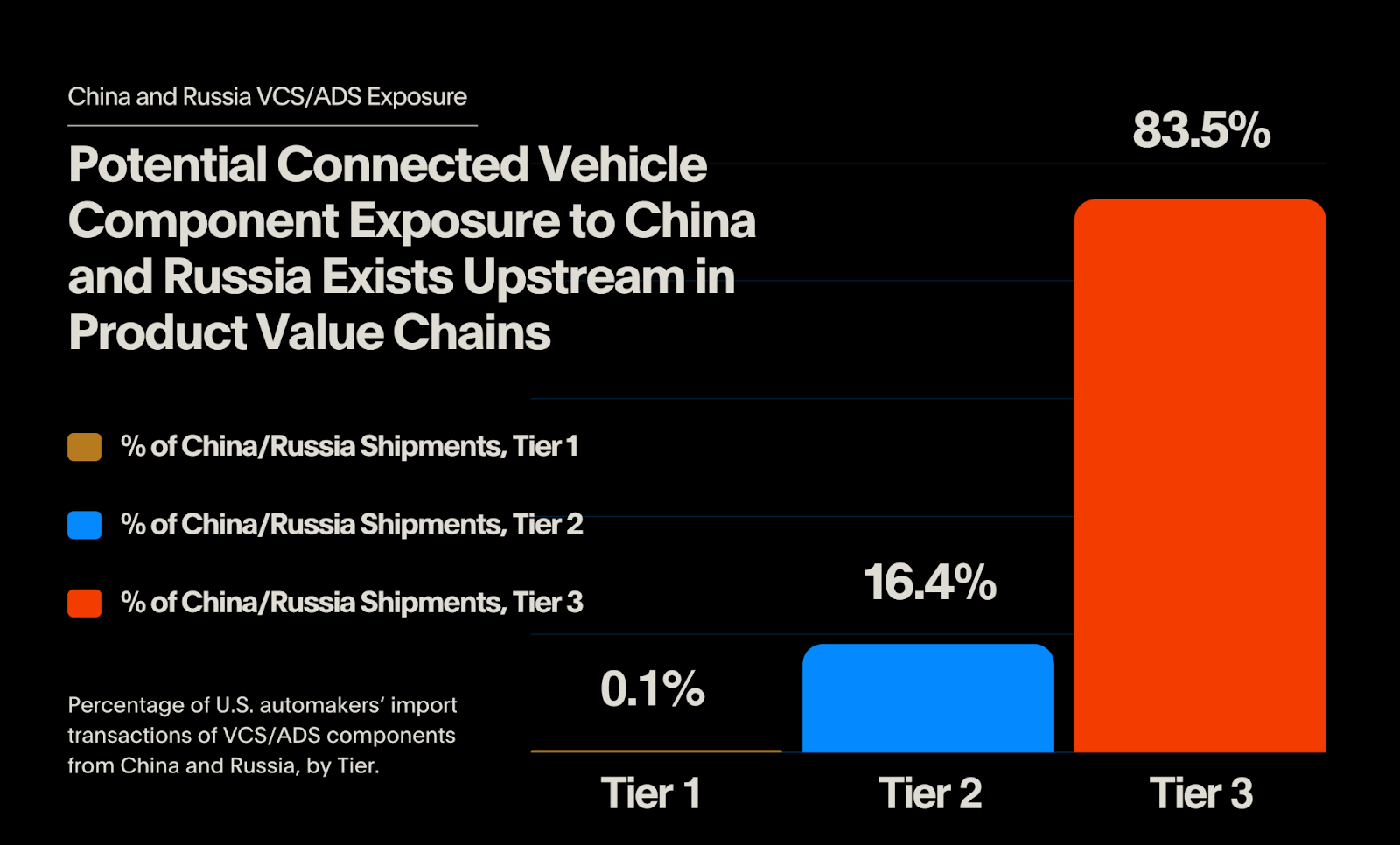

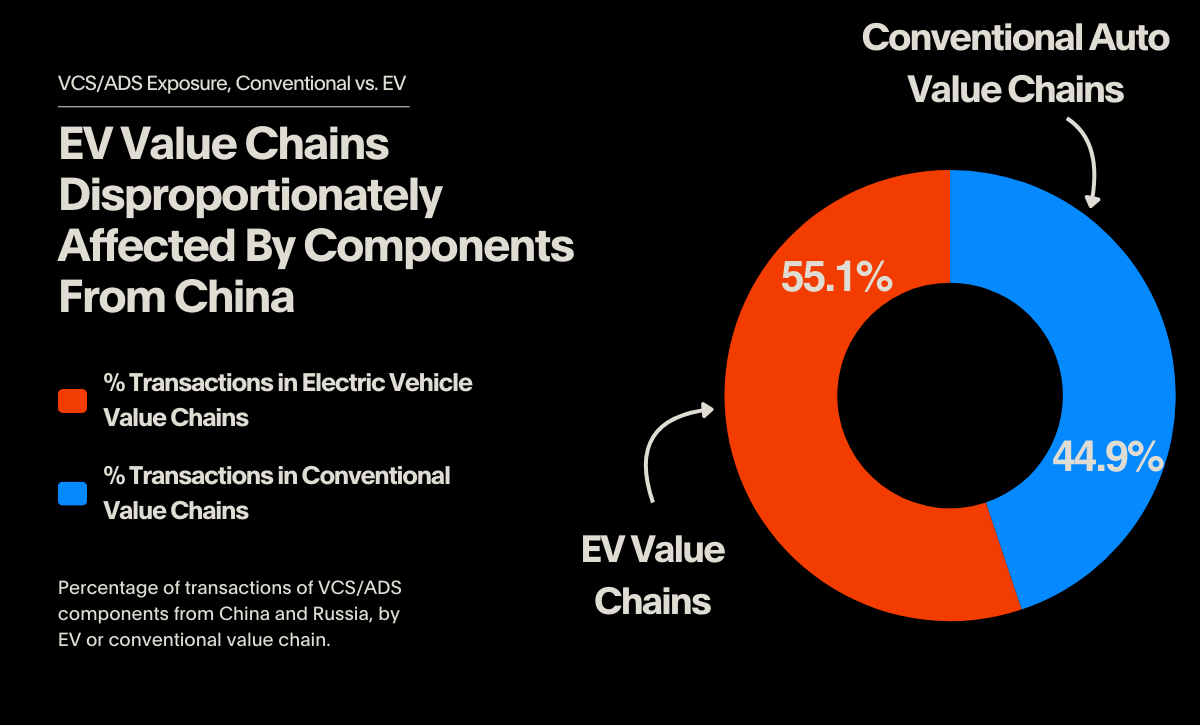

The new rules highlight a problem that has long plagued the automotive industry: a lack of upstream visibility beyond Tier 1 suppliers. The OBBBA's focus on critical minerals and their extraction and processing demands automakers trace their supply chains all the way to the mine or soil. An analysis by Altana reveals that the majority of exposure to foreign components occurs in Tier 2, Tier 3, and even further upstream. For connected vehicle components, more 83% of transactions linked to Chinese and Russian suppliers occurred at Tier 3 or beyond. Compared to conventional, gas-powered automotives, EVs are susceptible to adversarial components upstream, the analysis demonstrates. Despite EVs only making up roughly 10% of new car sales, 55% of U.S. automakers’ value chains with exposure to Chinese components are for EVs.

Components and raw materials necessary for remote battery management and monitoring, remote diagnostics, external charging controls, large telematics systems, and other vital EV components rely on Chinese refinement and manufacturing.

This dependence on China across multiple tiers of the EV supply chain — from mining critical materials to refining and ultimately assembling batteries and components — threatens eligibility for the EV tax credit.

The AI-powered solution

Altana's AI-driven Product Network offers a powerful solution. By connecting buyers, suppliers, logistics providers, and regulators into a shared network, they can provide the end-to-end visibility that automakers need. This technology can ingest raw ownership data — including Ultimate Beneficial Ownership (UBO) information — and crawl the entire ownership network of a supplier. It can then flag any entity that appears on the various SDN/Entity lists and, crucially, perform the complex ownership calculations required by the new FEOC rules. Critically, this must be done not only for Tier 1 suppliers, but for all suppliers across N-tiers of a product’s value chain. This allows an automaker to quickly determine if a supplier is compliant or non-compliant, providing the clarity needed to make strategic sourcing decisions.

The road ahead

The new rules are part of a fundamental and ongoing realignment of the global automotive supply chain, and automakers have an opportunity to gain competitive advantage by building secure, compliant and resilient product value chains.

By leveraging advanced AI platforms to gain deep visibility into their value chains, American automakers can ensure compliance with the OBBBA, protect their market share, and deliver on the promise of the EV transition.