Integrated EU supply chain means companies need sub-tier visibility to understand full tariff exposure

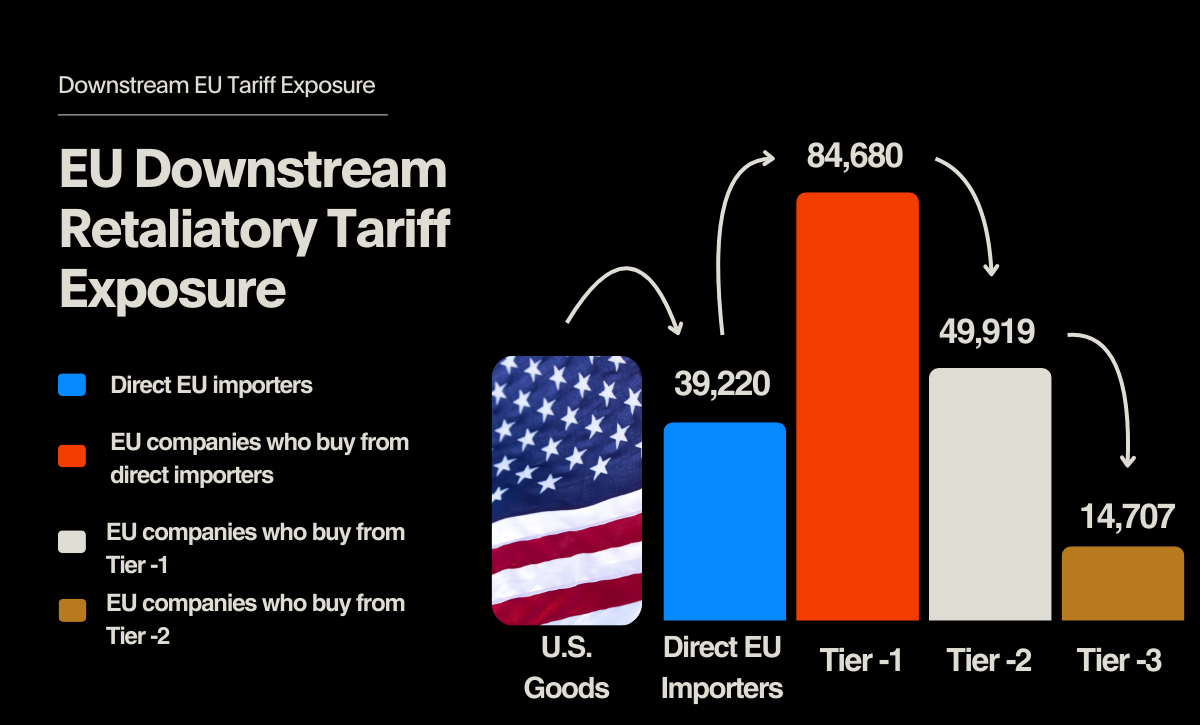

On March 11, 2025, the European Union announced counter-measure tariffs to up to €26 billion on U.S. imports, a sum intended to match the economic scope of new 25% U.S. tariffs on EU steel, aluminum and derivative products. The measures affect a large range of U.S. goods, from petroleum and agricultural products, to lawn mowers, to wines and spirits, and will be applied in mid-April 2025. Altana analyzed billions of shipment records from hundreds of millions of companies, and identified more than 39,000 European companies that imported affected products directly from the U.S. in 2023 and 2024.

Altana’s data also indicated that about 150,000 additional companies are exposed to new tariffs despite not being direct importers, as they are customers of the 39,000 direct importers. The importers may pass the cost of retaliatory tariffs further down the supply chain to a huge swath of EU enterprises.

The Integrated EU Supply Chain, and Deep Tariff Exposure

The EU supply chain is highly integrated, and the 39,000 companies that received direct imports from the U.S. in 2023 and 2024 are a fraction of the total number affected by retaliatory tariffs. Altana’s analysis reveals about 150,000 other companies across the bloc are exposed to the new tariffs deep within their product value chains — the network of materials, components, and human inputs from the soil to the store shelves that make up a good.

The 39,000 companies that import goods subject to the new EU tariffs in turn supply about 150,000 other companies on lower tiers of the supply chain, Altana’s analysis shows.

About 85,000 European companies purchase goods from the 39,000 importers. Then, about 50,000 companies buy from those 85,000. Another 15,000 companies purchased goods from those 50,000. The result: cascading tariff exposure, flowing deeper and deeper into the European supply chain, in which the cost of levies is likely distributed across tiers and European nations.

The top five member states most affected by the tariffs are the Netherlands, Belgium, Germany, Italy, and Spain, according to Altana’s analysis of UN Comtrade data. Other countries were spread throughout the EU. The top categories subject to tariffs are spirits, wine, ethylene polymers, lumber and nuts.

Indirect, Cascading Downstream Tariff Exposure in Practice

What does the cascading retaliatory tariff exposure look like in practice? In 2023, the EU imported $1 billion in wood and forest products exports from the U.S. Wood and forest products include lumber, plywood, veneer, flooring, chipboard, fibreboard, pulp, and paper. Say a lumber supplier imports a large shipment of U.S. sawn pine and spruce. The lumber supplier sells the boards to a national chain of lumber yards, who in turn supply furniture and cabinet makers, homebuilders, flooring manufacturers, and more. It supplies lower-grade U.S. wood to companies that make paper and fuel. Each of those buyers add value to the lumber and sell wood products to their own customers — furniture shops, homes and other structures, flooring, books, newspapers, and other printed products.

This story is repeated over and over and across product lines, from homes made of wood to bottles made of plastic. Companies in Tier -2 or Tier -3 of the supply chain, closer to end consumers, may not even have visibility into the original source of their product components. They are exposed to the tariffs indirectly, and the source of their exposure is possibly obscured.

How can these companies get visibility into their product value chains, accurately forecast tariff exposure, prioritize the right supplier relationships, and even find alternative suppliers who won't pass on tariff costs?

Mastering Tariffs With Altana's Tariff Scenario Planner

Without deep visibility into product-level value chains, companies doing business in the EU risk significant financial and operational disruption. Adjusting to tariffs means being able to quantify risk, adjust sourcing strategies, and build more resilient, profitable supply chains with precision and speed. Altana’s product network, built with artificial intelligence, provides a dynamic, intelligent, universal map of the entire global supply chain using first-party intelligence. The result is a shared source of truth on the global supply chain, informed by the data of many of the world’s largest organizations — and the only product network connecting buyers, suppliers, logistics service providers, and regulators. With Altana, you can:

- Visualize and analyze your value chain connections, identifying hidden relationships and risks.

- Collaborate with partners across your value chains to build more resilient, compliant, and cost-effective product lines.

- Request, share, and link product information across your supplier network to build traceability upstream and downstream, saving time gathering product information, and resolving risk by adding proof of compliance.

Specifically, our new Tariff Scenario Planner helps you navigate trade volatility with precision and speed — powered by the most comprehensive view of your product-level, multi-tier value chains. Unlike other solutions that rely on fragmented data, Altana’s Planner is built on your product networks. This enables you to make faster, more informed trade decisions that drive profitability while competitors scramble for answers.

With our Tariff Scenario Planner, you can:

- Pinpoint exposure: See the precise share of your product costs impacted by the new tariffs, down to the shipment level.

- Prioritize supplier relationships: Identify which suppliers pose the highest cost risk, so you can execute the right diversification strategy.

- Find alternative sources faster: Search for qualified suppliers outside of affected trade lanes to reduce risk and maintain supply continuity.