President Donald Trump’s 25% tariffs on Canada and Mexico, which went into effect on March 4, 2025, with a one month reprive for U.S. automakers, will scramble the highly integrated, multi-billion dollar North American auto parts market when implemented. They will raise costs for thousands of importers and upend trade of the components that make up the U.S.’s most popular vehicles, an Altana analysis reveals. Whether or not it forces investment in domestic manufacturing as intended, the tariffs will hit thousands of U.S. automakers, engineering facilities, parts suppliers and repair shops who will soon be paying more for auto parts from two of America’s largest trading partners. To get a handle on the breadth and depth of the tariffs' impact, Altana analyzed value chain data for thousands U.S. importers of auto components under 22 six-digit tariff codes. The analysis covered the year 2024, with the analyzed codes corresponding to an assortment of vital auto components, from spark plugs and wipers to brakes and servo parts to suspension systems and shock absorbers.

Thousands of Affected U.S. Importers Rely on Range of Auto Components

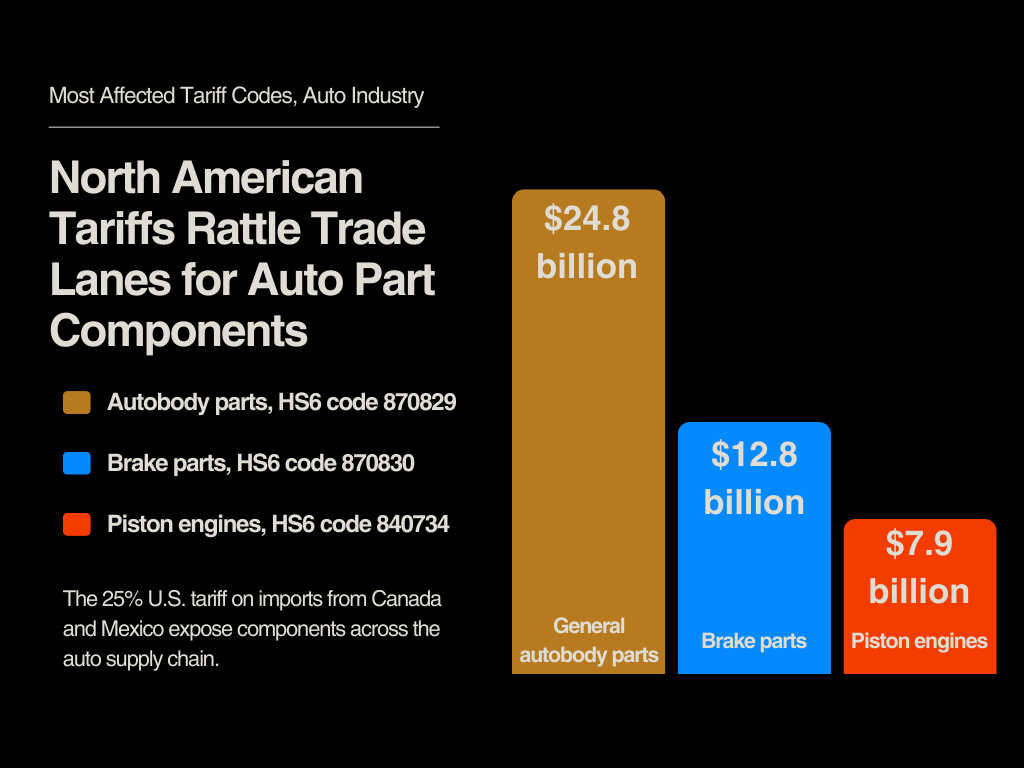

Across both trade lanes, hardest hit categories are:

- A catch-all code for auto body parts ($24.8 billion in exposure, HS6 code 870829)

- Brakes and brake parts ($12.8 billion in exposure, HS6 code 870830)

- Reciprocating piston engines, which convert high temperature and high pressure into a rotating motion ($7.9 billion in exposure, HS6 code 840734)

A range of importers rely on these parts to fulfill their role in the auto supply chain. For just the three hardest hit categories, there are more than 2,000 importers for the catch-all autobody code, more than 600 importers of brakes and brake parts, and 57 importers of the piston engines, the analysis revealed.

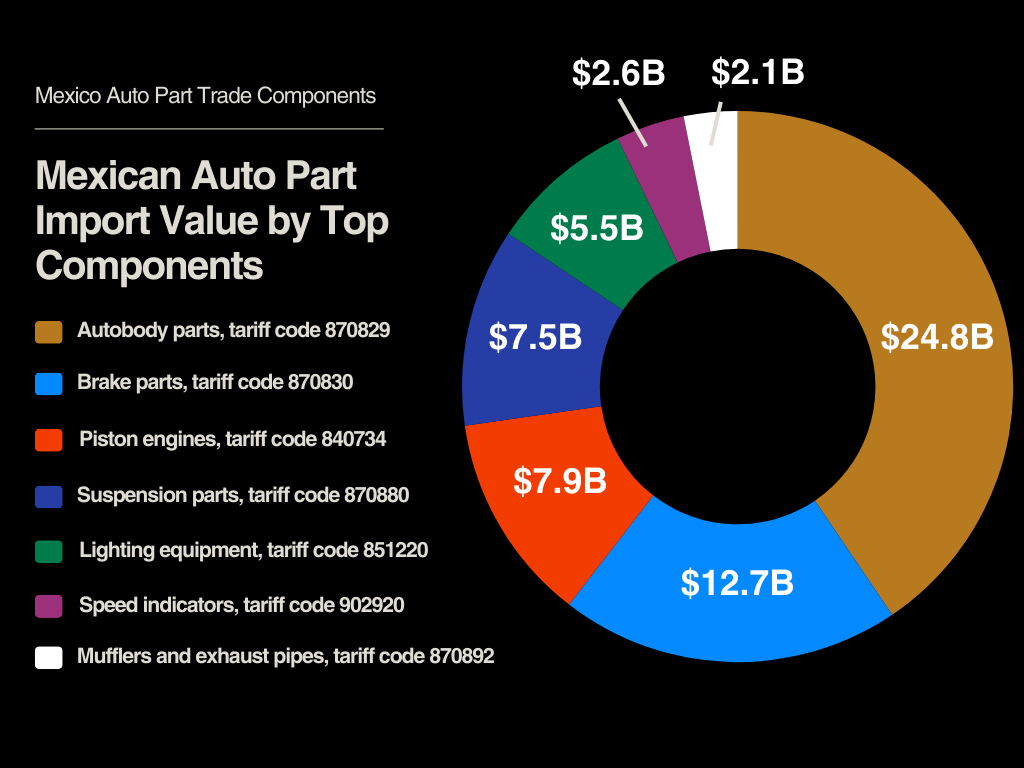

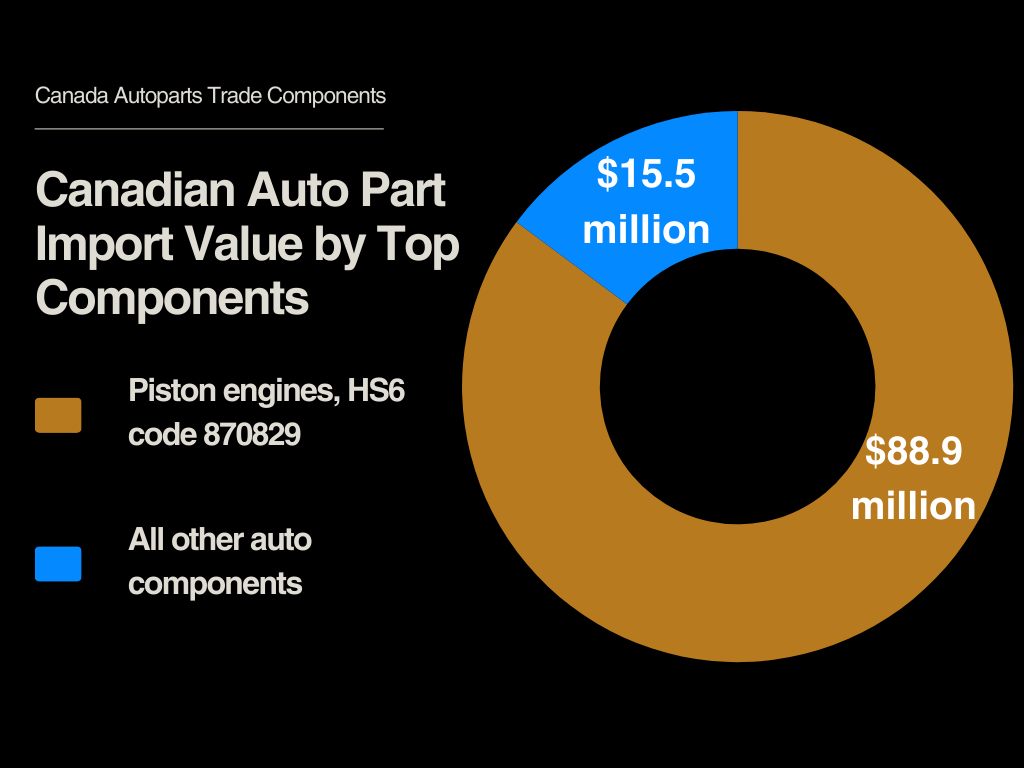

Beyond the difference in volume of imports, Altana’s analysis also found that the Mexico to U.S. auto trade lane is more diversified across auto components than the Canada to U.S. trade lane, which is mostly made up of piston engines.

Mastering Tariffs With Altana's Tariff Scenario Planner

Without deep visibility into product-level value chains, automakers risk significant financial and operational disruption. Adjusting to tariffs means being able to quantify risk, adjust sourcing strategies, and build more resilient, profitable supply chains with precision and speed. Altana’s product network, built with artificial intelligence, provides a dynamic, intelligent, universal map of the entire global supply chain using first-party intelligence. The result is a shared source of truth on the global supply chain, informed by the data of many of the world’s largest organizations — and the only product network connecting buyers, suppliers, logistics service providers, and regulators. With Altana, you can:

- Visualize and analyze your value chain connections, identifying hidden relationships and risks.

- Collaborate with partners across your value chains to build more resilient, compliant, and cost-effective product lines.

- Request, share, and link product information across your supplier network to build traceability upstream and downstream, saving time gathering product information, resolving risk by adding proof of compliance.

Specifically, our new Tariff Scenario Planner helps you navigate trade volatility with precision and speed — powered by the most comprehensive view of your product-level, multi-tier value chains. Unlike other solutions that rely on fragmented data, Altana’s Planner is built on your product networks. This enables you to make faster, more informed trade decisions that drive profitability while competitors scramble for answers.

With our Tariff Scenario Planner, you can:

- Pinpoint exposure: See the precise share of your product costs impacted by the new tariffs, down to the shipment level.

- Prioritize supplier relationships: Identify which suppliers pose the highest cost risk, so you can execute the right diversification strategy.

- Find alternative sources faster: Search for qualified suppliers outside of affected trade lanes to reduce risk and maintain supply continuity.