Printed circuit boards (PCBs), an essential electronic component, rely heavily on Chinese sub-components hidden deep in product value chains, Altana’s analysis of global supply chain behavior shows. To bolster resilience, plan for possible national security tariffs, and identify alternative suppliers, electronics manufacturers and brands need a trusted Product Network.

Printed circuit boards (PCBs) are essential parts of nearly all electronic goods, from consumer electronics and connected vehicles to defense articles like radar, satellites, and unmanned aerial systems (UAS).

China dominates global PCB production, originating about 67% of global exports, according to Altana analysis of UN Comtrade data. Less realized, but visible in multi-tier product value chains in Altana’s Product Network, is the vast reliance on China’s production of the sub-componentry necessary to create a functional PCB assembly — resistors, capacitors, diodes, semiconductor parts, specialized wire and cable, and electronic integrated circuits.

This sub-componentry is present even in finished supplies of PCBs sent from countries like India and Vietnam to the U.S., leaving global supply of this critical electronics component exposed to China’s bans on exports of critical minerals, as well as potential Section 232 tariffs, pending the resolution of U.S. Department of Commerce investigations into processed critical minerals, semiconductors, polysilicon, and their derivative products. See how printed circuit board assemblies illustrate the extent to which U.S. supply chains that depend on advanced electronics components also depend on manufacturing in an adversarial nation — and remain vulnerable to fluctuations in tariffs and trade restrictions. You’ll also learn how Altana’s Product Network bolsters resilience through visibility, traceability, and collaboration.

PCB supply chain demonstrates resilience challenges in direct shipments and far upstream in product value chains

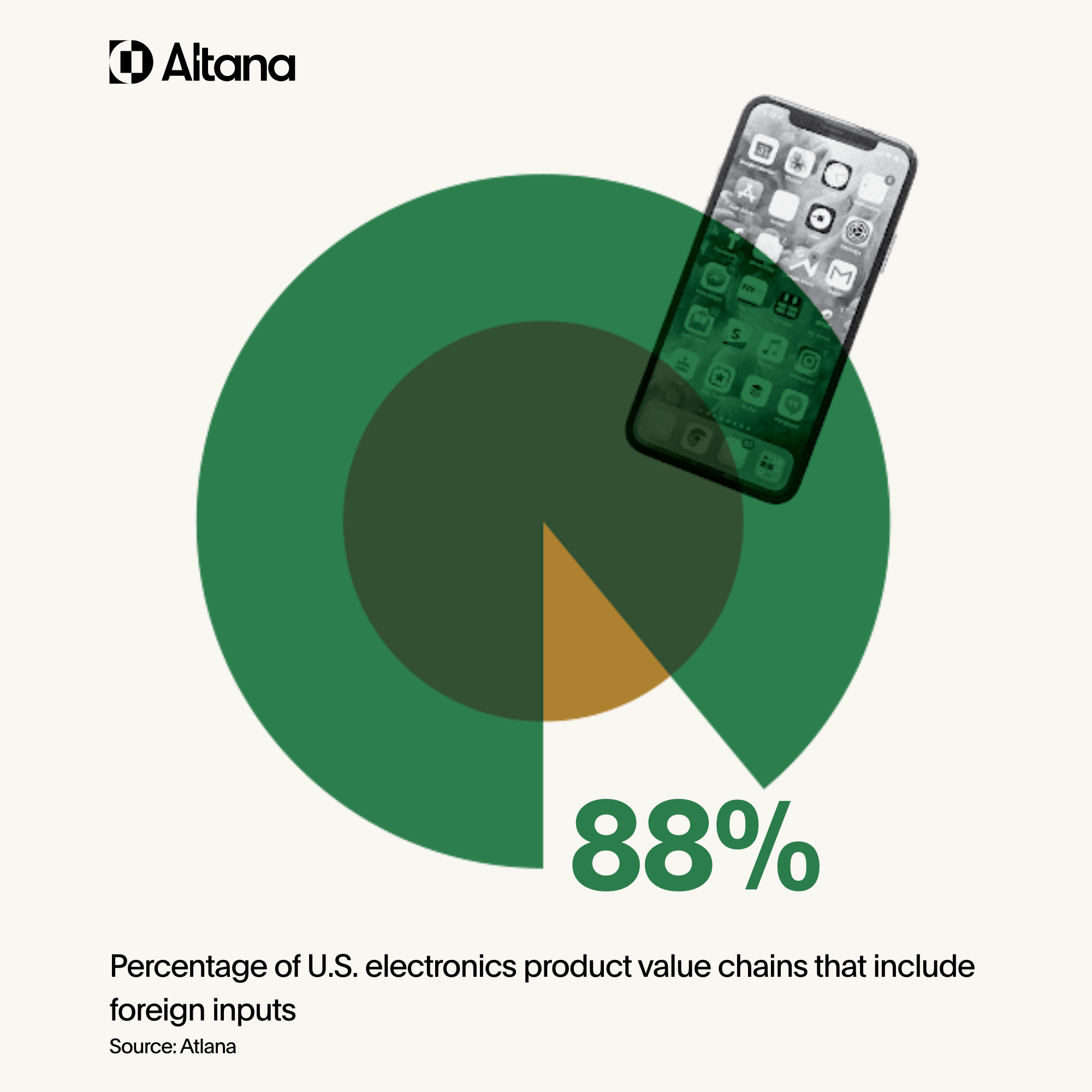

Altana’s PCB analysis reveals that U.S. electronics value chains are broadly dependent on foreign inputs, and demonstrates that both direct shipments and activity upstream in product value chains introduces exposure to manufacturing in adversary nations.

The manufacturing of U.S. electronics and electronics components is today only possible with foreign suppliers: 88% of electronics product value chains include foreign inputs, Altana found.

Included in this foreign electronics content is a significant reliance on suppliers in China. 24.4% of electronics suppliers in Tier 1, 2, 3, and beyond in U.S.-bound electronics product value chains are located in China, according to the analysis.

The PCB supply chain illustrates how easing this dependence on China requires not just knowledge of direct shipments and Tier 1 suppliers, but also visibility deep into product-specific value chains.

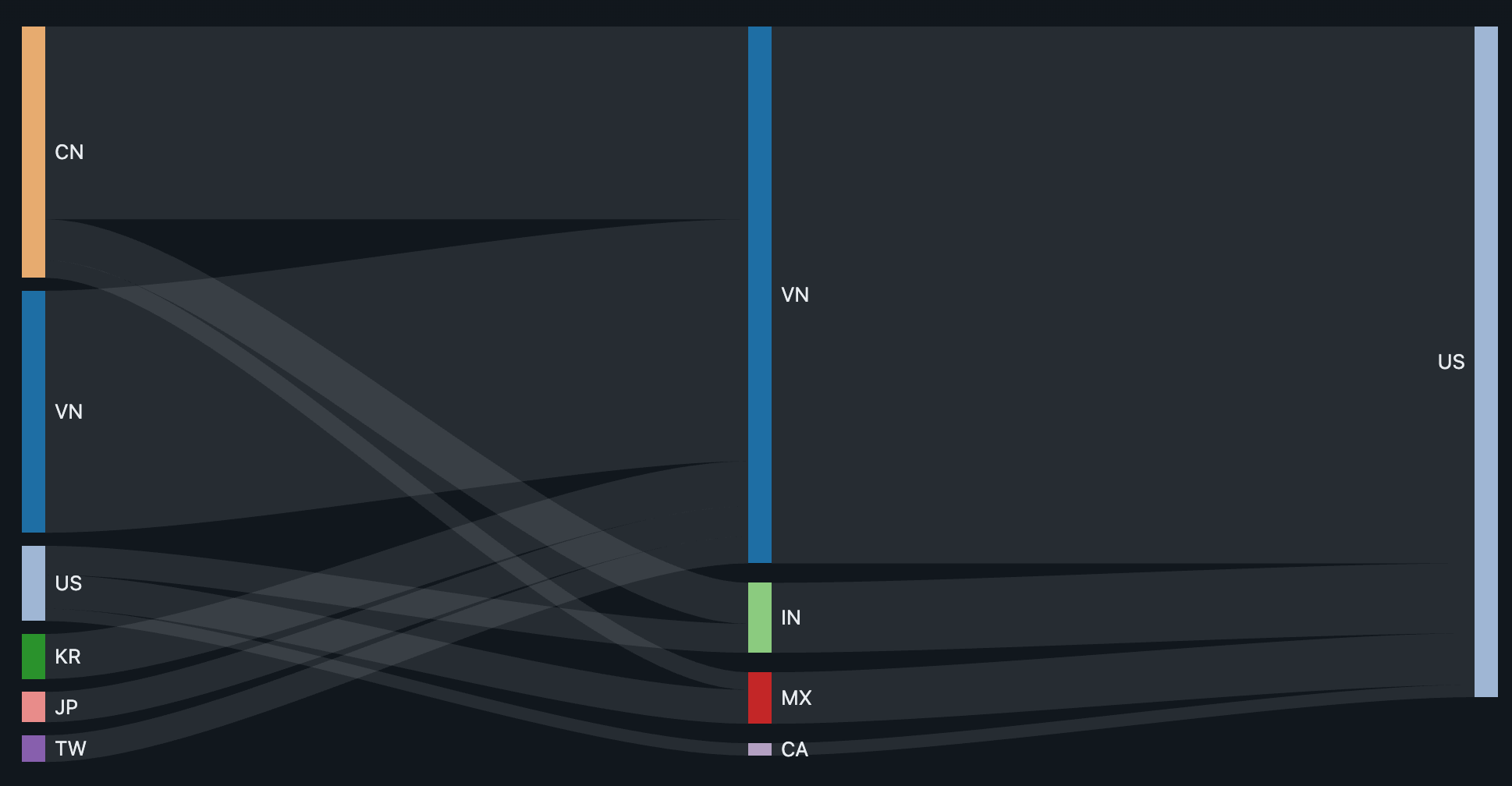

About 67% of the global exports of PCBs originate in China, and value chain illumination by Altana’s Product Network reveals additional, unseen China reliance upstream in U.S.-bound PCB shipments from friendlier trading partners, such as Vietnam and India.

In 2024, Vietnamese manufacturers consigned more than 7,000 shipments of PCBs to the U.S. valued at about $78 million, Altana’s analysis reveals. Roughly 20% of that trade included Chinese components from upstream in the supply chain.

Printed circuit board shipments bound for the U.S. frequently have Chinese exposure upstream (Number of PCB and PCB component transactions, 2024)

India registers even more upstream reliance on China: In 2024, more than 61% of India’s roughly $23 million in U.S.-bound PCB shipments had Chinese sub-components upstream.

China was also the primary upstream supplier of sub-components for Mexican PCB manufacturers that supply the U.S. Across all PCB supply chains that lead to the U.S, China was the largest source by value of upstream components in 2024.

PCB supply chain registers significant exposure to China export controls on critical minerals, Section 232 tariff investigations

Altana’s analysis indicates that exposure to the Chinese supply of PCBs and PCB components threatens the security of electronics supply chains and could introduce significant component-based tariffs. China has imposed export controls on critical minerals and magnets, while the U.S. Department of Commerce has launched Section 232 national security tariff investigations into critical minerals, semiconductors, polysilicon, and derivative items necessary for PCB production.

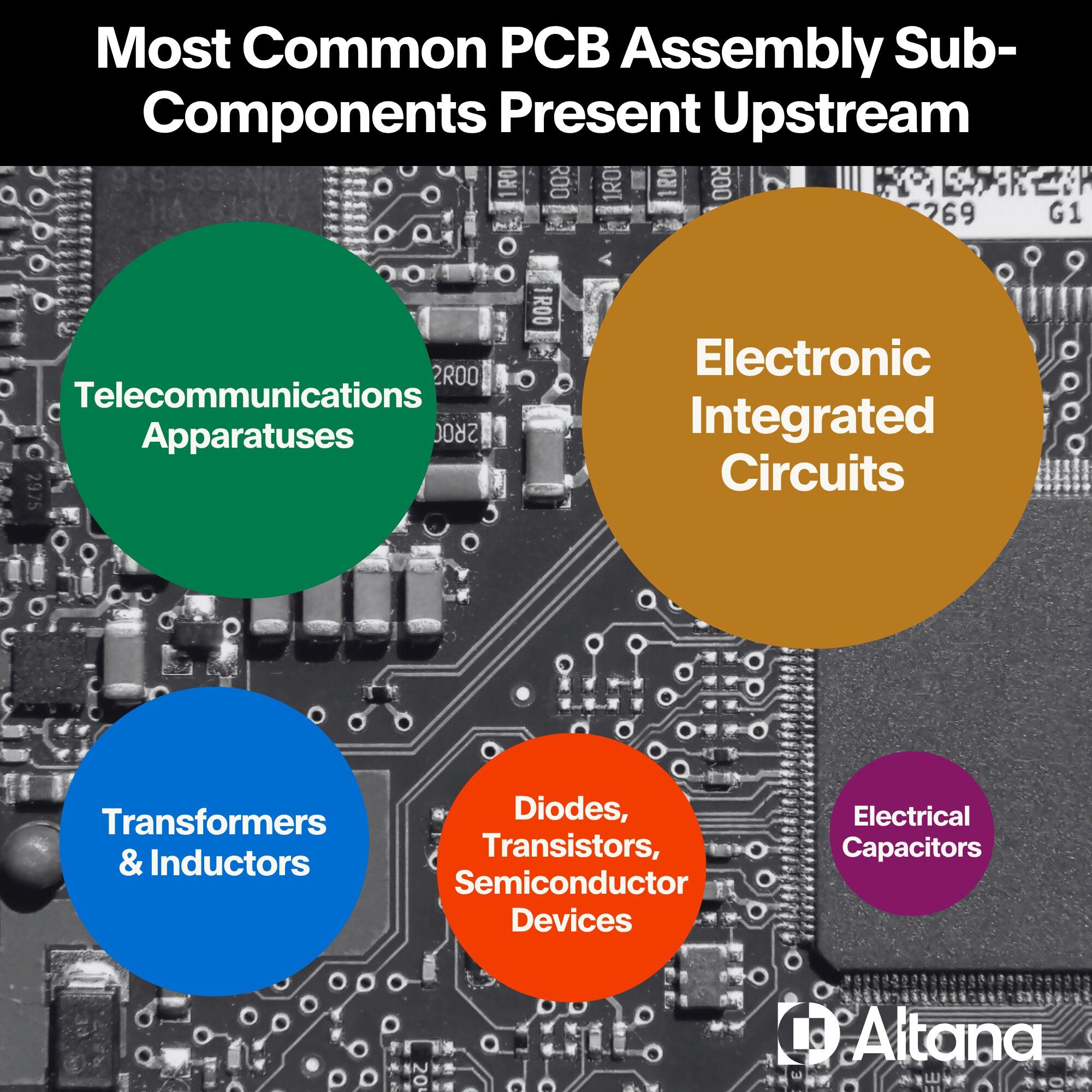

The most common PCB sub-components present upstream in the product value chains illuminated by Altana’s Product Network were electronic integrated circuits; telecommunications apparatuses; transformers and inductors; diodes, transistors, and other semiconductor devices; and electrical capacitors.

Each of these components, which are nestled in multi-tier, multi-national value chains, introduce resilience risks in the form of Chinese extraterritorial critical minerals export bans and potential national security tariffs by the U.S.

China controls most of the world’s critical metals and minerals refinement, and PCB sub-componentry depends significantly on critical minerals that are subject to forms of Chinese export controls and restrictions. For example, gallium and germanium are essential materials in electronic integrated circuits and diodes, transistors, and other semiconductor devices. Given the important role of PCBs in consumer electronic devices and electronic components in automotive, defense, and manufacturing applications, critical mineral restrictions create supply challenges across a broad swath of U.S. supply chains. Even as U.S. buyers of rare earth minerals begin identifying alternative trade lanes and sourcing opportunities to bypass Chinese export restrictions, the electronics industry has another looming challenge: Section 232 investigations, a formal inquiry conducted by the U.S. Department of Commerce to determine if the quantity or circumstances of imports of a particular article threaten to impair U.S. national security. Launched in April 2025 into foreign critical minerals and semiconductors and July 2025 into polysilicon, these investigations could lead to higher tariffs on inputs and components vital to electronics supply chains. Section 232 tariffs enable the U.S. president to apply sectoral tariffs on imported articles and their derivative items. Current Section 232 national security tariffs on steel and aluminum apply 25% levies on raw steel and aluminum, derivative components such tubes, pipe fittings, and ropes and cable, and finished products with steel and aluminum content, such as refrigerators, dishwashing machines, and stoves. For finished products, importers must pay a levy on the declared value of steel and aluminum content. Similar rules for critical minerals, semiconductors, and polysilicon could cause tariff rates for electronics imports to skyrocket. As with critical minerals, myriad components within PCBs and the broader electronics supply chain rely on polysilicon.

Electronics brands and manufactures in other industries that rely on electronics components need to ask:

- If the administration does impose national security tariffs, will the electronics industry, or certain electronics components, receive exemptions?

- Will imports of specific electronics components be subject to a form of percentage-based levies on semiconductors, polysilicon, and critical minerals content?

- And how will quantifying and mitigating exposure to a complex swirl of levies, export controls, and other resilience risks be possible with so much of the exposure present upstream, in Tier 2, 3, and beyond in value chains?

Bolster resilience and achieve visibility, traceability and collaboration in electronics value chains with Altana’s Product Network

Presently, most U.S. electronics, automotive, and defense manufacturers lack the tools and means to see, secure, and control upstream product value chains, leaving blind spots in their reliance on foreign manufacturing capacity.

With Altana's Product Network, brands and manufacturers that need electronics components get an entirely new way of working: A trusted Product Network, featuring a resilient, adaptable ecosystem that connects buyers and suppliers across PCB and other electronics value chains.

Altana’s Product Network makes it possible for electronics and automotive manufacturers, DIB primes, contractors, and sub-contractors to illuminate, design and collaborate across product-level value chains to identify and mitigate resilience challenges, manage costs, and source secure suppliers.

The Product Network enables visibility, traceability, and collaboration:

- Visibility is an instant, dynamic map of N-tier relationships at a product level. AI reveals specific multi-tier product value chain connections and uncovers relationships and risks, such as upstream exposure to an adversarial supplier of critical PCB components.

- Traceability is detailed data and documentation on a product’s lifecycle, as verified by upstream suppliers, to confirm where critical dependencies exist.

- Collaboration means closer relationships and real-time communication with government agencies and regulators. Altana Product Passports enable collaboration with upstream and downstream supply chain partners, allowing importers of PCBs and other electronic components and applications to validate compliance, stress test resilience, identify alternative suppliers, and design secure value chains.