The analysis indicates that major U.S. auto manufacturers have systemic upstream exposure to newly prohibited VCS and ADS components, with electric vehicle manufacturers facing significant exposure.

The analysis also demonstrates that without the ability to design and document product-level value chains, featuring collaboration with upstream suppliers, U.S. automakers won’t be able to comply with the connected vehicle security mandate, adapt to other trade regulations, and profitably navigate tariffs and other geopolitical business considerations.

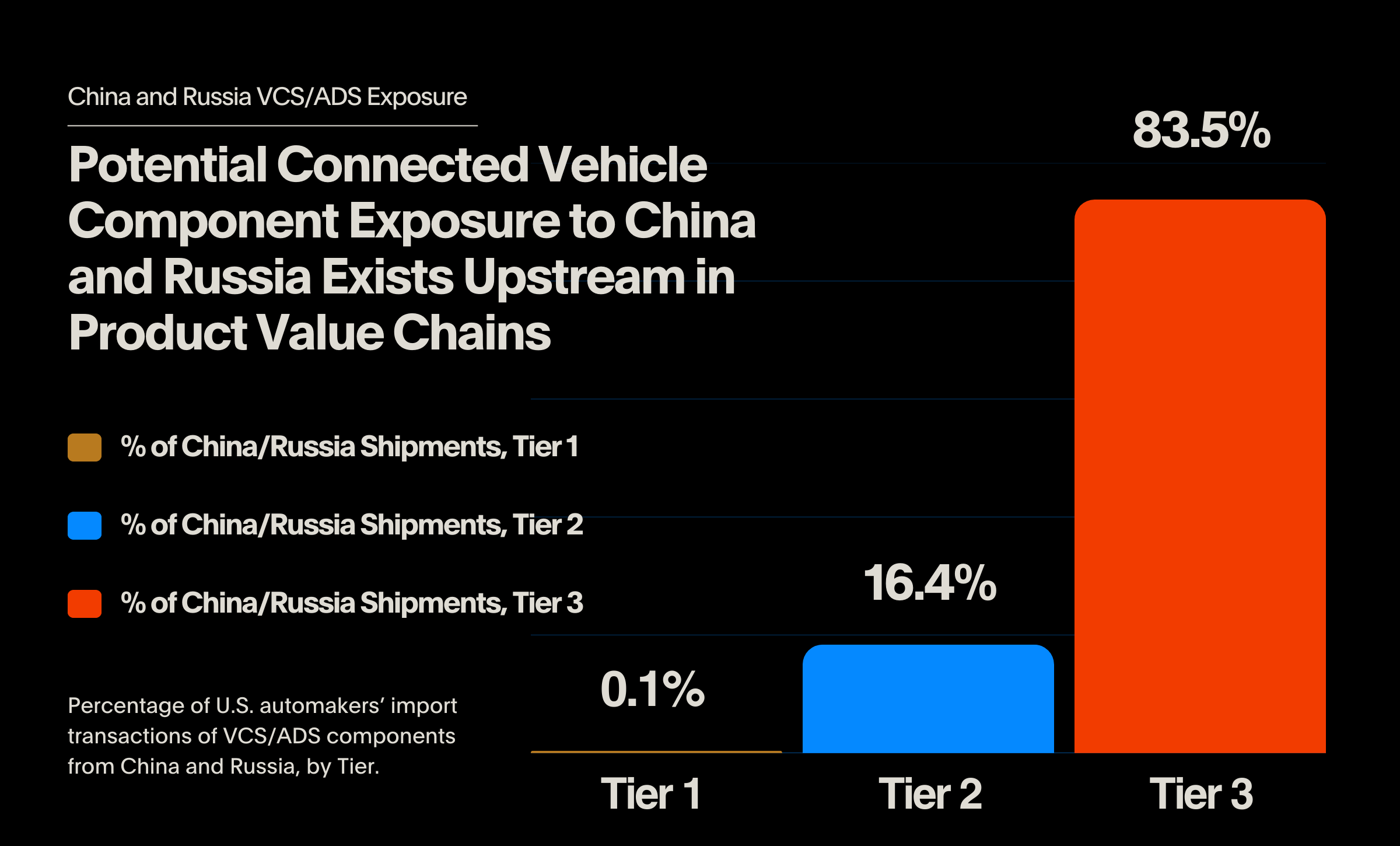

99.9% of Transaction-Level VCS/ADS China and Russia Exposure Present at Tier 2 or Further Upstream

American automakers’ exposure to potential connected vehicle violations overwhelmingly occurs upstream in product value chains, where it risks being hidden and unanalyzed.

Of the 280,753 import transactions to U.S. auto manufacturers that are associated with VCS/ADS components and have Chinese or Russian suppliers, 234,511 are in Tier 3, 45,967 are in Tier 2, and 275 are in Tier 1. The vast majority of the analyzed import transactions come from China, which has large, developed auto electronics manufacturing capabilities.

How far upstream is the potential exposure to Chinese and Russian components? 83.5% of the analyzed VCS/ADS component transactions occur at Tier 3 or beyond. Research from Gartner indicates that only 17% of organizations have substantial visibility into Tier 3 suppliers. Without vastly improved upstream visibility beyond Tier 1, identifying potential Chinese and Russian exposure and proving connected vehicle compliance is effectively impossible for auto manufacturers.

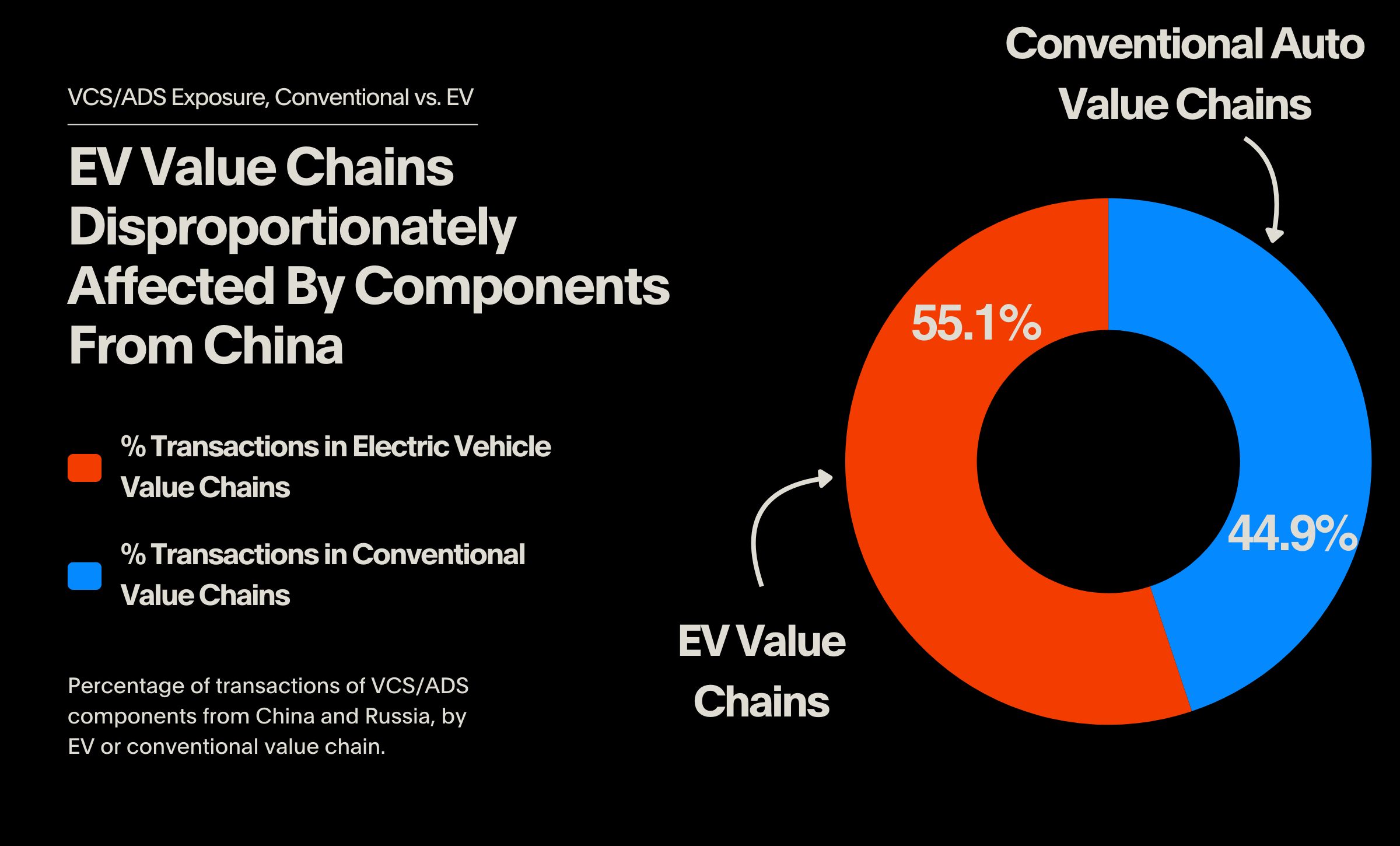

Electric Vehicle Manufacturers Hugely Exposed to Chinese and Russian Components

The majority of the U.S. automakers’ potential exposure to connected vehicle rule violations is linked to electric vehicles.

Of the 280,753 total transactions linked to China or Russia, 154,779 (55.1%) are part of an electric vehicle value chain; less than half are associated with value chains flowing into a conventional, gas-powered car.

What makes electric vehicle value chains so susceptible to Chinese and Russian VCS/ADS components, despite electric vehicles only making up roughly 10% of new car sales? Electric vehicles are reliant on connected features that interact with external networks, which is the focus of the connected vehicle mandate. When analyzing electric vehicle value chains, a constellation of components associated with VCS/ADS systems — such as remote battery management and monitoring, remote diagnostics, external charging control, inverter control boards with connected visibility, large telematics systems, and more — appear regularly. Many EVs are also equipped with autonomous driving capabilities that rely heavily on sensory networks, central control units, and external connectivity, all of which are targeted by BIS regulations on Chinese and Russian parts.

In conventional auto vehicle value chains, the exposure of VCS/ADS violations is more limited to components like audio and visual systems that are connected to traditional external connectivity capabilities, such as cellular networks, Wi-Fi, and Bluetooth.

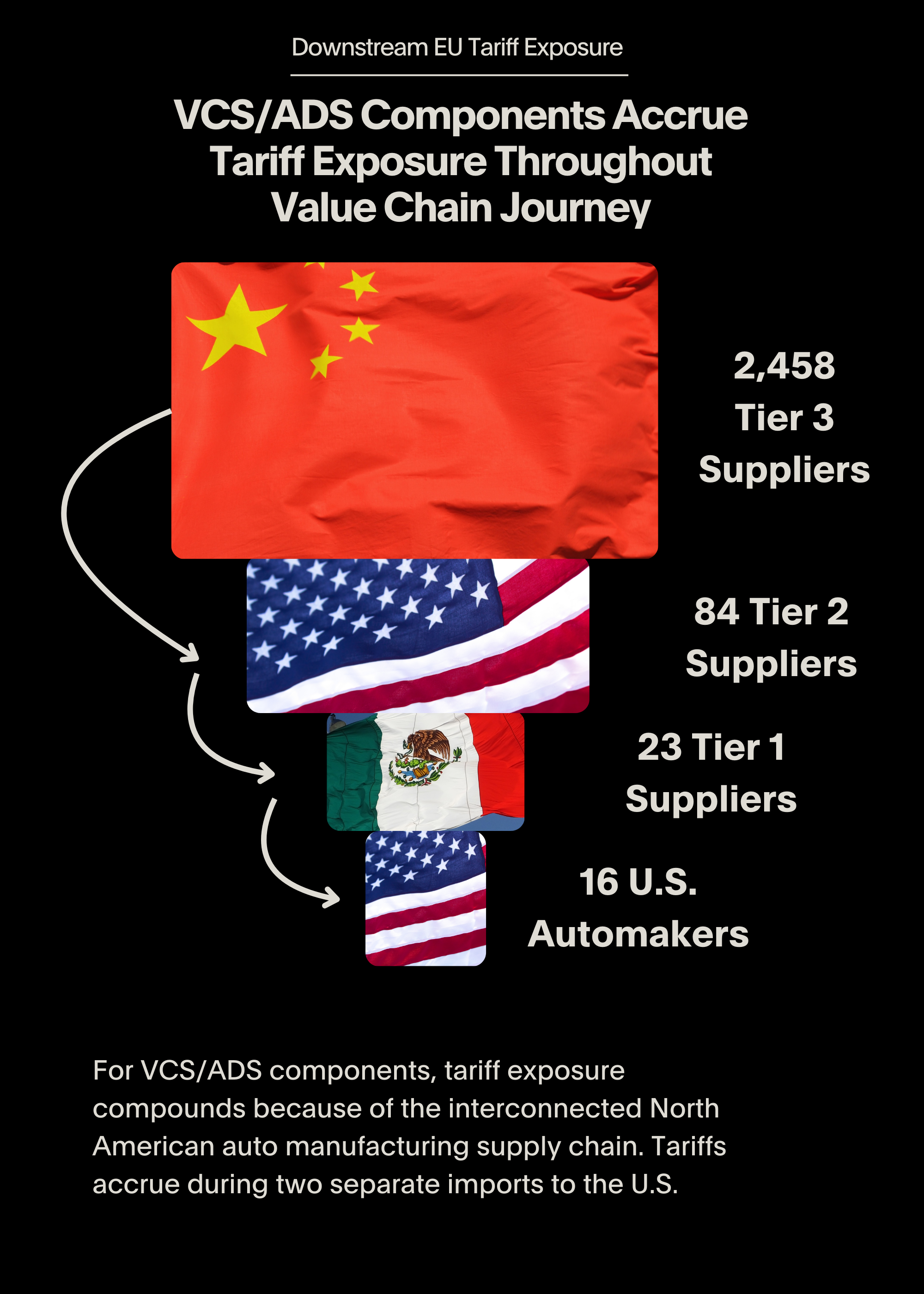

VCS/ADS Components Cascade Through Interconnected North American Auto Value Chains, Threatening Non-Compliance and Introducing Compounding Tariff Exposure

Exposure to Chinese and Russian VCS/ADS components doesn’t just compromise U.S. automakers’ ability to comply with connected vehicle mandates. This exposure also cascades through a tightly interconnected North American auto supply chain, introducing compounding tariff exposure.

The North American auto supply chain is typified by manufacturers shipping autos across borders to different manufacturing centers. Here’s how such compounding exposure appears in practice. Altana’s analysis uncovered 2,458 Tier 3 VCS/ADS component suppliers in China. The biggest non-Chinese trading partner for these Tier 3 suppliers: 84 U.S. Tier 2 manufacturers that receive the Chinese components. The 84 U.S. Tier 2 manufacturers themselves most frequently supply 23 Mexican Tier 1 manufacturers, who then import finished auto products back into the U.S. for 16 automakers.

The result: cascading, compounding tariff exposure. For a single product value chain, manufacturers are tagged with tariffs on China to U.S. imports, and now, with 25% tariffs on all vehicles imported to the U.S., additionally incur the cost of Mexico to U.S. imports. Product Breakdown: Accumulating Tariff Exposure on VCS/ADS Components

Here’s how a silicon wafer from China passes through the U.S. border twice as it transforms into a radio frequency integrated circuit chip that enables wireless communication and safety features like adaptive cruise control and collision avoidance for an electric vehicle.

Tier 3 — China

Silicon is mined and refined in China, which is the world’s leading producer of silicon. A Chinese manufacturer takes the refined silicon and manufactures silicon wafers that can be used in the production of electronic devices.

Tier 2 — U.S.

The silicon wafer is imported by a U.S. manufacturer of radio frequency integrated circuit chips (RFIC). RFICs are fabricated on silicon wafers, and the U.S. manufacturer uses the Tier 3 silicon wafer from China to fabricate its RFIC.

RFICs are used in a number of electronic devices, and are crucial in modern automotives, as they enable wireless communication and advanced safety features by handling radio frequency signals on a single chip.

Tier 1 — Mexico

The RFIC is shipped from the U.S. to an auto manufacturer in Mexico. As part of manufacturing an entire car, the Mexican auto manufacturer installs the Tier 2 RFIC, made from a Tier 3 Chinese silicon wafer.

Tier 0 — U.S.

A mostly or fully manufactured car, which includes the RFIC chip made from a Chinese silicon wafer, is shipped from Mexico back into the U.S. for assembly to an auto brand that sells cars to American consumers. This auto brand now has exposure to Chinese components in its value chain, must pay an import tariff for the shipment from Mexico, and also may absorb tariff costs from manufacturers along the value chain that had to pay import levies every other time the component crossed the U.S. border.

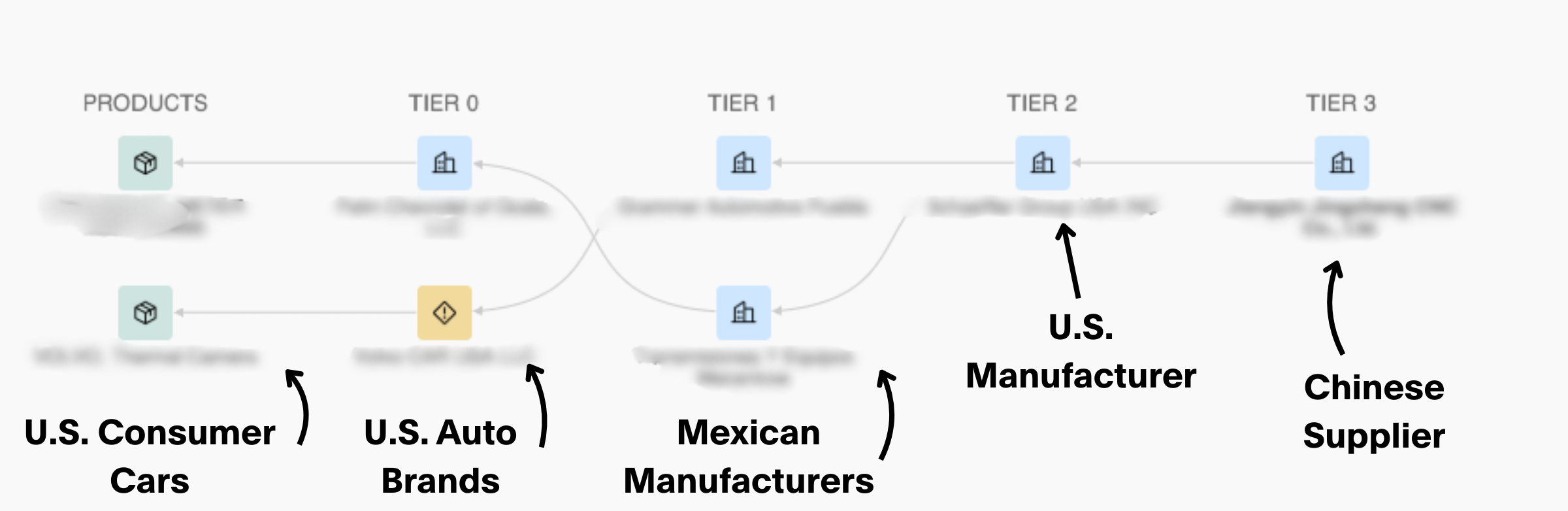

View from Altana's Product Network

In the Altana Product Network, it's possible to visualize how a single manufacturer in China, which produces silicon wafers, supplies VCS/ADS components that are in two specific cars sold by different U.S. auto brands.

This trade lane demonstrates China to U.S. to Mexico to U.S. flow of goods.

Mastering the Connected Vehicle Security Mandate — and Developing a Comprehensive Supply Chain Strategy for Tariffs and Other Challenges — With Altana’s Product Network

Unlike data sources that only allow automakers to map relationships between companies, facilities, and other entities, Altana makes it possible to illuminate, design and collaborate across product-level value chains. For every product, Altana ingests automakers’ existing understanding of their value chains from their bill of materials, and marries this understanding to dynamic data from the product network. The end result is better visibility, further upstream in product-specific value chains, that illuminates risks such as Chinese and Russian VCS/ADS components. These risk assessments reveal impacts for specific product value chains but can be run at scale, giving a comprehensive, product-driven view of supply chain vulnerabilities.

Altana’s product network also helps automakers demonstrate due diligence through collaboration with other entities in their product networks, including upstream suppliers across multiple tiers. Traceability documentation can be gathered directly in Altana, in the context of relevant, product-specific value chains. As automakers get more information from suppliers, their understanding of their product value chains improves and evolves.

With this foundational network visibility and connectivity, automakers can proactively design, manage, and monitor their supply chains to navigate pressing issues driven by geopolitical uncertainty, including: other compliance and trade regulations, exposure to tariffs and an expanding trade war, and general gaps in supply chain resilience. Within Altana, automakers can quantify the business impacts of these risks through a multi-tier assessment across products, suppliers, and materials.

Of particular importance to auto manufacturers: quantifying the financial impact of tariffs, and reducing their impact on revenue and profits. Altana’s Tariff Scenario Planner makes it possible to navigate tariffs with precision and speed — powered by the most comprehensive view of product-level, multi-tier value chains. Unlike other solutions that rely on fragmented data, Altana’s Planner is built on business’s product networks. This enables automakers to make faster, more informed trade decisions that drive profitability while competitors scramble for answers.

With our Tariff Scenario Planner, automakers can:

- Pinpoint exposure and quantify impact: See the precise share of product costs impacted by the new tariffs, down to the shipment level.

- Prioritize supplier relationships: Identify which suppliers pose the highest cost risk and execute the right diversification strategy.

- Identify and analyze alternative sources by generating scenarios to support value chain design and supply chain planning efforts: Search for qualified suppliers that meet selection criteria and strategic objectives.

As geopolitical tensions continue to rise, automakers will face ongoing pressure to comply with regulations such as the connected vehicle security mandate, control tariff costs to protect margins, and build resilient value chains that limit geopolitical risk exposure. Mastering this new era of trade will require deep connection and collaboration across product-specific value chains, which is only possible with Altana’s product network.

About the Analysis

Altana analyzed more than 2.5 million transactions of 12,903 automotive suppliers and 18 major U.S. automakers. Altana identified these transactions through a mix of data analysis, including goods descriptions associated with the electronic connectivity components found in autos.