Analysis reveals significant NDAA compliance challenges for U.S. defense industrial base; tens of thousands of yearly imports with upstream exposure to Chinese military entities

An analysis from Altana’s Product Network – built on the world’s most comprehensive body of supply chain data – reveals significant, upstream adversarial dependence and looming National Defense Authorization Act (NDAA) violations for the U.S. defense industrial base (DIB).

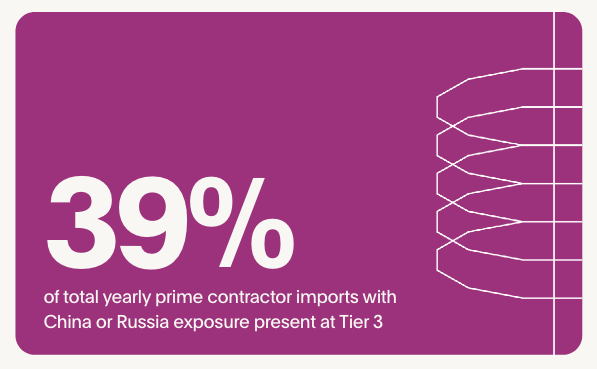

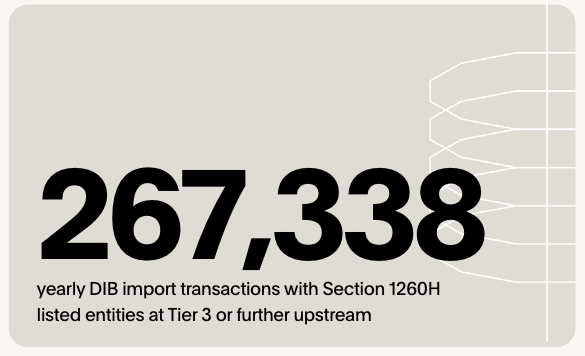

In 2024, 39% of total yearly defense prime contractor imports had China or Russia exposure present at Tier 3 or beyond, with 267,338 of the imports containing upstream exposure to Chinese military entities flagged under NDAA Section 1260H. In coming years, this upstream exposure will result in a ban on contracting with the Department of Defense, and a loss of lucrative government contracts.

Learn more about the extent of the defense industrial base's compliance challenges and how Altana's Product Network offers contractors and sub-contractors the visibility, traceability, and collaboration needed to secure product value chains and avoid NDAA violations.

Why does NDAA Section 1260H matter for the DIB?

In the last five years, the National Defense Authorization Act (NDAA) has been burnished with a compounding set of provisions that prohibits the Department of Defense (DoD) from engaging with entities linked to Chinese military companies.

A particular challenge for the defense industrial base: Section 1260H, first introduced in 2021, requires the Department of Defense to publish yearly a list of Chinese military companies operating directly or indirectly in the U.S.

Section 805 of the Fiscal Year 2024 NDAA prohibits the DoD from contracting with entities flagged under the 1260H provision, with enforcement becoming more intense every year:

- Starting on June 30, 2026, the DoD will be prohibited from entering into direct contracts on listed entities.

- One year later, in 2027, the prohibition extends to indirect procurements, meaning defense contractors must ensure their supply chains are free from goods, services, and technology from these listed Chinese military companies – or they will lose government contracts.

Altana’s analysis indicates that in advance of 2027, defense contractors will struggle to comply with NDAA Section 1260H rules barring Chinese military suppliers in their upstream supply chains.

This general reliance on China and Russia also applies to upstream dependence on entities flagged by the Department of Defense as Chinese military entities. In 2024, the analysis uncovered 267,338 import transactions in which Section 1260H listed entities were present in Tier 3 or further upstream.

Given the Gartner finding that only 17% of Chief Procurement Officers have visibility into Tier 3 suppliers, it’s likely that many prime DIB contractors and their sub-contractors don’t presently have an honest accounting of their vast, business-critical Section 1260H exposure.

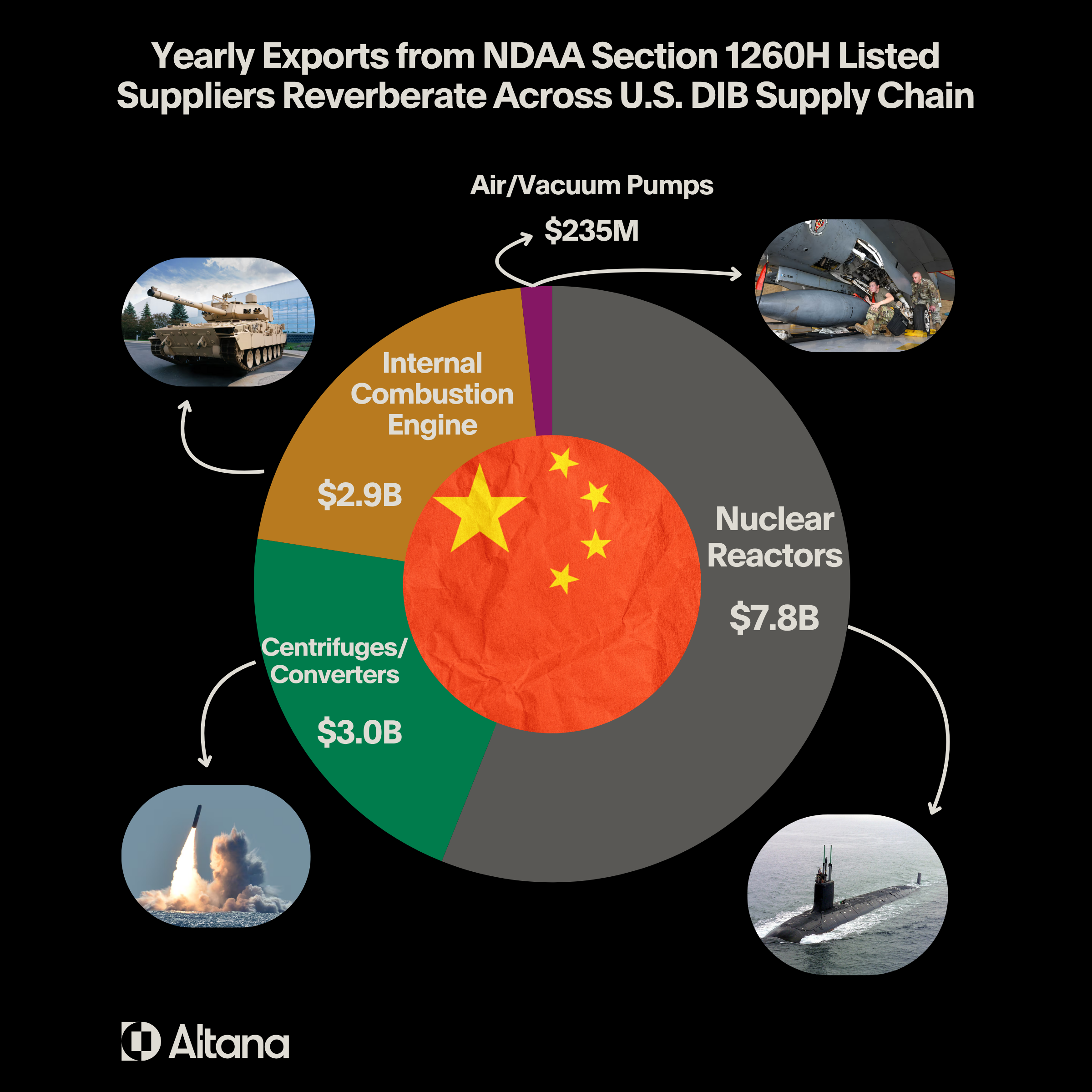

High-value upstream imports from Section 1260H listed suppliers reverberate across U.S. DIB supply chain

The analysis further reveals that the upstream exposure to Chinese entities listed under Section 1260H of the NDAA affects billions of dollars of yearly imports to U.S. defense contractors.

$7.8 billion of shipment value flowing from nuclear reactors and nuclear reactor parts contains upstream exposure to Chinese military entities. Nuclear reactors are a vital component in ballistic submarines, the warships that transport and stage hypersonic weapons, and other applications.

Listed Chinese entities also exist upstream in the high-value trade lanes of centrifuges and converters ($3 billion yearly); internal combustion engines ($2.9 billion yearly); and air-vacuum pumps ($235 million yearly). These parts are vital for producing missiles, tanks, automotives, pneumatic conveyers, service parts, and other specialized military equipment.

Get DIB value chain visibility, traceability, and collaboration with Altana’s Product Network

Unlike tired supply chain technology that requires burdensome and inaccurate manual mapping, risk screening tools, and supplier surveys, Altana’s Product Network makes it possible for DIB contractors and sub-contractors to illuminate, design and collaborate across product-level value chains to identify and mitigate NDAA Section 1260H violations.

- Visibility means getting an instant, dynamic map of N-tier relationships at a product level. AI reveals specific multi-tier product value chain connections and uncovers hidden relationships and risks, such as upstream exposure to entities flagged on the Section 1260H list.

- Traceability means having detailed data and documentation on a product’s lifecycle, as verified by upstream suppliers, to confirm a lack of NDAA violations.

- Collaboration means closer relationships and more real-time communication with government agencies and regulators. Altana Product Passports can be used to collaborate with upstream and downstream supply chain partners, specifically allowing DIB contractors and sub-contractors to work directly with DoD to validate their suppliers' NDAA compliance

About the Analysis

Altana analyzed the product value chains of 609 U.S. defense contractors and sub-contractors. The analysis evaluated 6.6 million multi-tier transactions in 2024.