Newly expanded Section 232 levies on steel and aluminum components and their derivatives greatly enlarge the base of U.S. companies exposed to the tariffs, Altana's analysis of global supply chain data shows. With Section 232 national security investigations underway on semiconductors, critical minerals, polysilicon, and other critical inputs, businesses need visibility, traceability, and collaboration on a trusted Product Network.

President Donald Trump’s expanded Section 232 tariffs on steel and aluminum derivative items will newly expose a vast number of U.S. companies across sectors to additional levies, even if they’re not importing raw metal materials. An analysis by Altana of the world’s most comprehensive body of supply chain data reveals that the White House’s expanding application of national security tariffs to imported steel and aluminum derivative products will strike 15 times as many companies and hundreds of billions of dollars more transactions than the president's 2020 national security tariffs on aluminum and steel products.

The expansion of steel and aluminum derivatives tariffs comes alongside ongoing Section 232 investigations into processed critical minerals, semiconductors, polysilicon, drones and drone components, and their derivative products.

See the extent to which 2025's round of derivatives tariffs on steel and aluminum expands tariff exposure for enterprises, and makes it necessary to know and manage the sub-components within products. You'll also get a glimpse of how potential Section 232 tariffs on other critical components could wreak havoc for other American supply chains.

2025 steel and aluminum derivatives tariffs rattle extended supply chains, especially automotives

In 2020, steel and aluminum Section 232 tariffs were applied to wire and cable, aluminum auto parts, nails, tacks, staples, spikes, and other metal products. In 2025, Section 232 tariffs have expanded to apply to downstream steel and aluminum goods like metal furniture and furniture frames, screws and bolts, pre-fabricated structural steel, aluminum baseball bats, aircraft parts, flatbed or cargo trailers, insulated electric conductors, door hinges, and much more.

For finished products, importers must pay a levy on the declared value of steel and aluminum content.

The expansion of Section 232 tariffs in 2025 to steel and aluminum sub-components and content within final products exposes more transactions, suppliers, and importers to levies, Altana's analysis found.

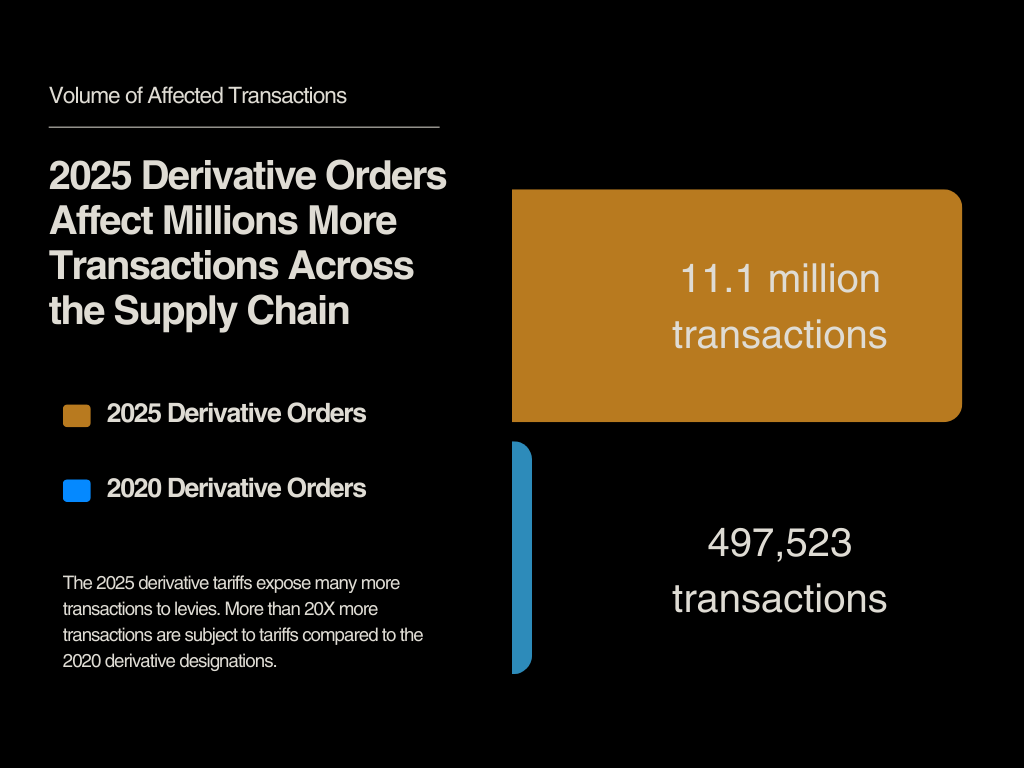

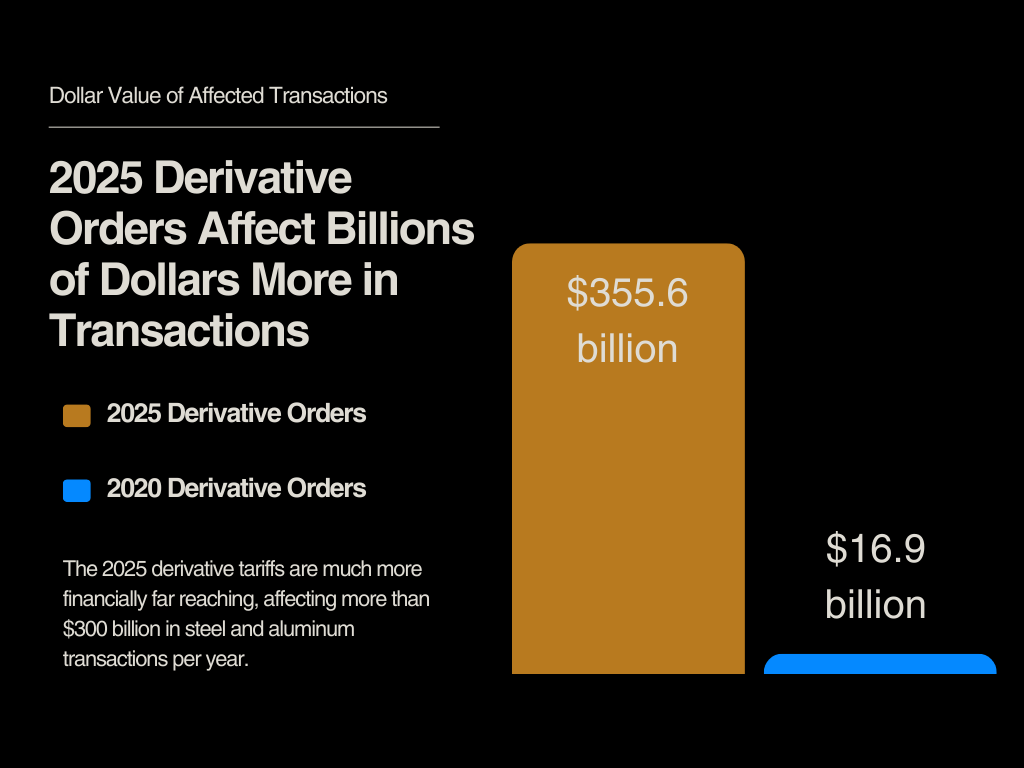

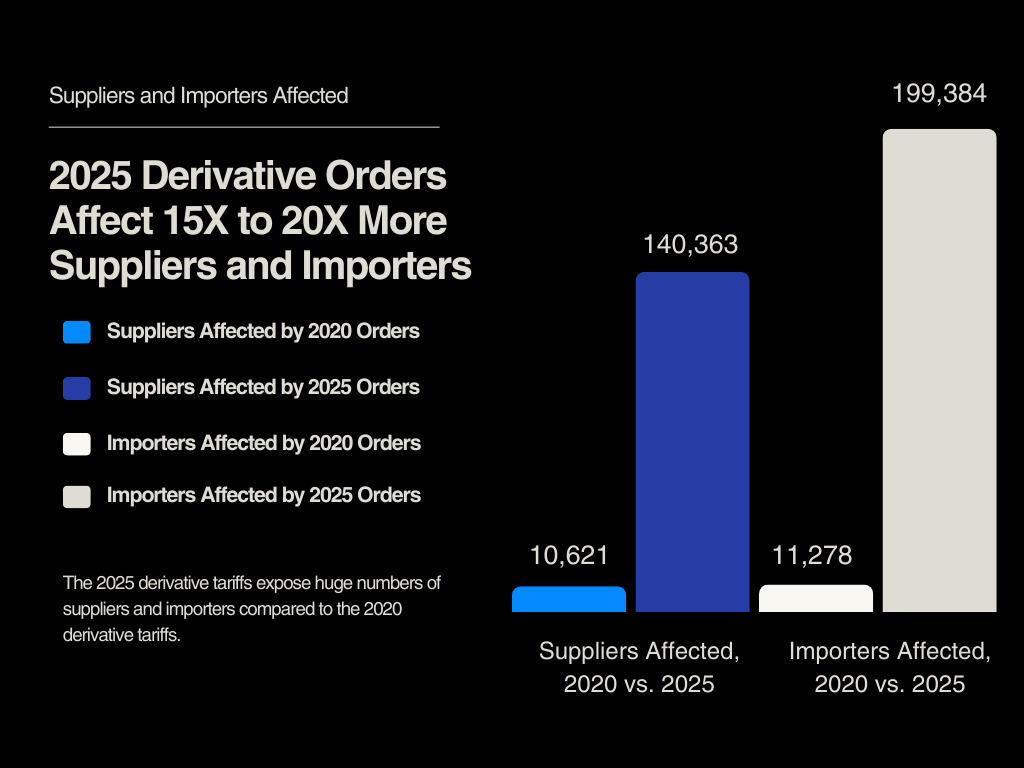

In 2024, nearly 200,000 U.S. companies conducted more than 11 million import transactions of steel and aluminum derivative articles subject to the new tariffs, compared to about 11,000 companies and 500,000 transactions for the 2020 levies, Altana’s analysis reveals. Those transactions were valued at more than $350 billion, compared to $17 billion in imports subject to the 2020 tariffs.

The effects of the derivatives additions on transactions is shown in the huge expansion in the number of suppliers and importers implicated. In 2024, companies sourcing steel and aluminum derivatives articles subject to the new additions used 140,363 suppliers. Only 10,621 suppliers were involved in steel and aluminum derivatives transactions exclusive to the 2020 list.

The new round of Section 232 derivatives disproportionately affect the auto industry, the U.S.’s largest importer of aluminum products, but also hit companies in scientific manufacturing, civil engineering, mining, transportation manufacturing, hardware and plumbing, and more.

Ongoing Section 232 investigations threaten high tariffs on additional products, components derivatives, and industries

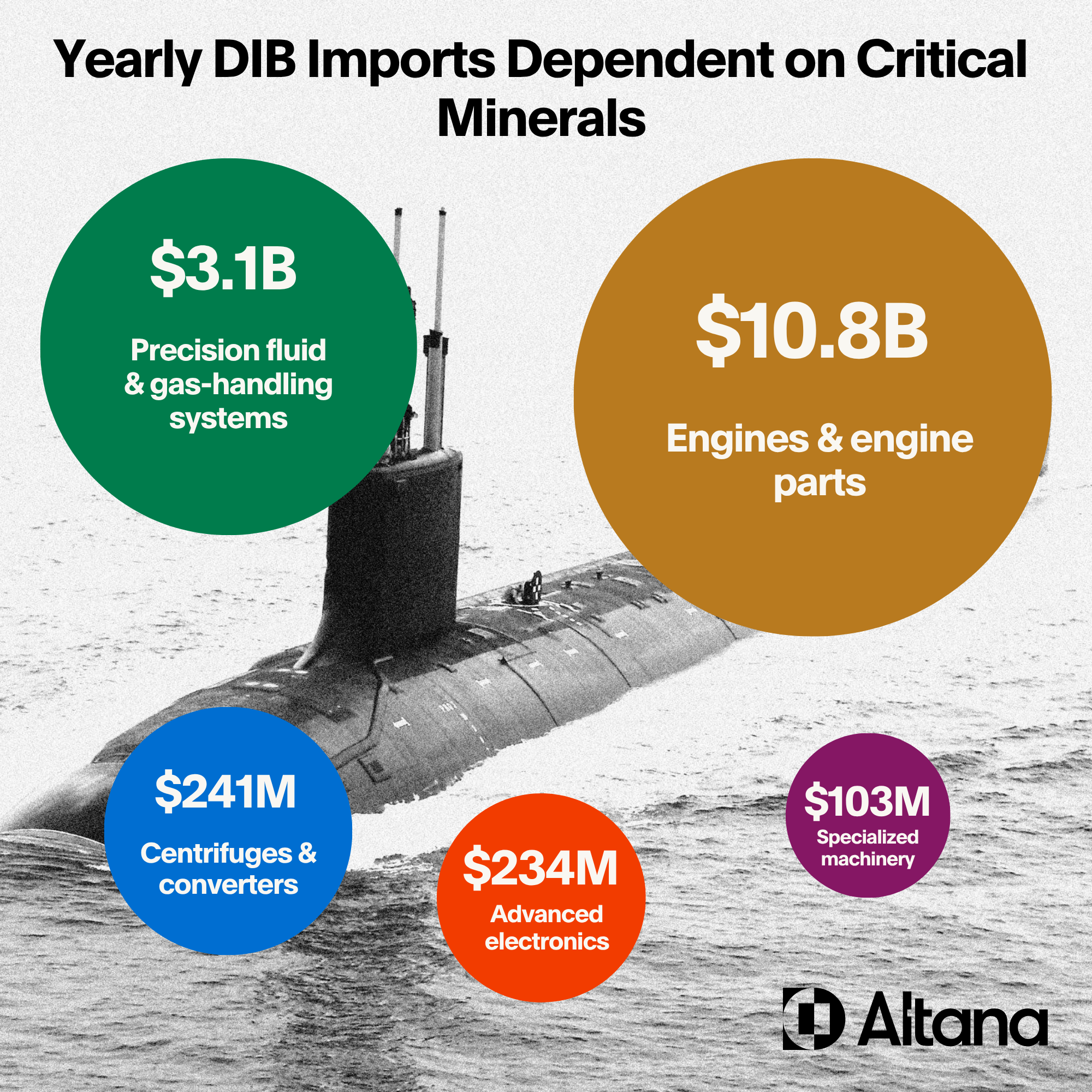

As U.S. enterprises adjust to significantly expanded steel and aluminum derivatives tariffs, electronics, defense, automotive, and other industries have another looming challenge: Additional, ongoing Section 232 investigations on more components. Launched in April 2025 into foreign critical minerals and semiconductors and July 2025 into drones, drone components, and polysilicon, these investigations could lead to higher tariffs on inputs and components vital to a large swath of American supply chains.

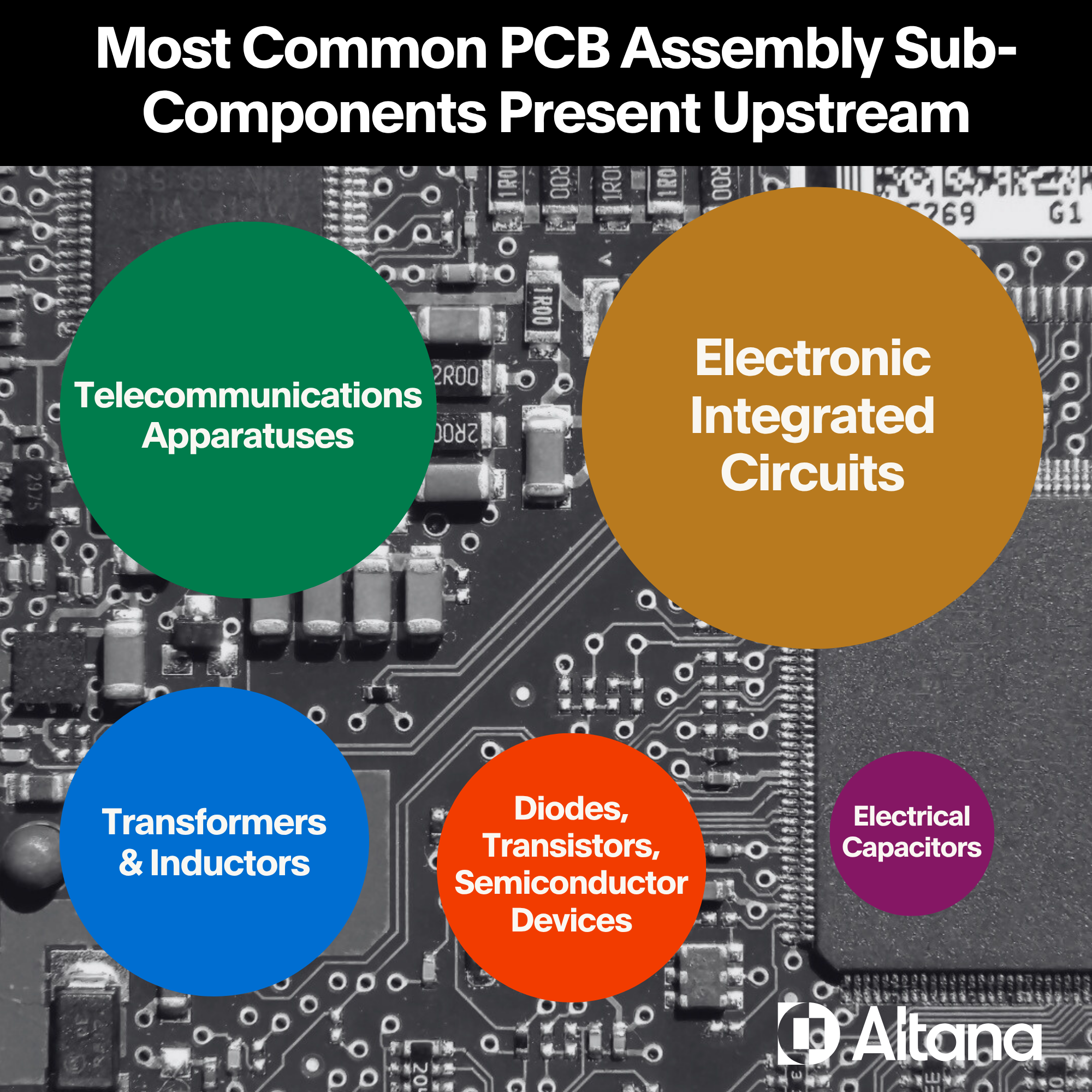

Electronics manufacturers, and enterprises across consumer electronics, defense, auto, and other industries that rely on electronics components, would be similarly exposed: Electronic sub-componentry, such as electronic integrated circuits and diodes, transistors, and other semiconductor devices for printed control boards (PCBs), require the critical minerals gallium and germanium, which are largely refined in China. Other vital electronics sub-components need polysilicon and semiconductors, for which separate Section 232 investigations are underway.

Played out investigation-by-investigation, and industry-by-industry, the expansion of Section 232 levies threatens cost increases and raises major questions for American enterprises:

- If the administration does impose additional Section 232 tariffs, will certain industries, or certain types of components or products, receive exemptions?

- Will imports of specific product components be subject to a form of percentage-based levies on semiconductors, polysilicon, and critical minerals content?

- And how will quantifying and mitigating exposure to a complex swirl of levies, export controls, and other resilience risks be possible with so much of the exposure present upstream, in Tier 2, 3, and beyond in value chains?

Navigate Section 232 tariffs with Altana's Product Network

Without deep visibility into product-level value chains, U.S. automotive, defense, electronics, and other manufacturers risk significant financial and operational disruption as Section 232 tariffs expand. The universe of affected importers and suppliers will increase once these derivatives come into effect. Enterprises will need to uncover hidden dependencies to quantify risk, adjust sourcing strategies, and build more resilient, profitable supply chains. Global commerce comprises hundreds of millions of companies and billions of transactions each year, and a single multinational corporation can work with tens and even hundreds of thousands of trading partners and dozens of regulators across the world. That's far too many for supply chain executives and compliance teams to handle manually. But advances in artificial intelligence and networked platforms enable suppliers, customers and regulators to collaborate across their networks, building trust and facilitating compliance in a dynamic and complex trade environment.

Altana’s artificial intelligence has built a dynamic, intelligent, universal map of the entire global supply chain using first-party intelligence from participants in our network. The result is a shared source of truth on the global supply chain, informed by the data of many of the world’s largest organizations — and the only product network connecting buyers, suppliers, logistics service providers, and regulators.

With Altana, you can:

- Visualize and analyze your value chain connections, identifying hidden relationships and risks.

- Collaborate with partners across your value chains to build more resilient, compliant, and cost-effective product lines.

- Request, share, and link product information across your supplier network to build traceability upstream and downstream, saving time gathering product information, resolving risk by adding proof of compliance.

Mastering Tariffs With Altana's Tariff Scenario Planner

The dynamic, fluid global trade landscape –– including Section 232 derivatives additions on aluminum and steel –– demands immediate attention and action to mitigate disruption to your supply chain and bottom line. Altana’s new Tariff Scenario Planner helps you navigate trade volatility with precision and speed — powered by the most comprehensive view of your product-level, multi-tier value chains.

Unlike other solutions that rely on fragmented data, Altana’s Planner is built on your product networks. This enables you to make faster, more informed trade decisions that drive profitability while competitors scramble for answers.

With our Tariff Scenario Planner, you can:

- Pinpoint exposure: See the precise share of your product costs impacted by the new tariffs, down to the shipment level.

- Prioritize supplier relationships: Identify which suppliers pose the highest cost risk, so you can execute the right diversification strategy.

- Find alternative sources faster: Search for qualified suppliers outside of affected trade lanes to reduce risk and maintain supply continuity.