Unifying enterprises, insurers, and brokers around supply chain resilience and coverage.

Hidden supply chain risks make it harder for enterprises, brokers, and insurers to align coverage with business needs.

Altana’s product network creates shared visibility across suppliers, enterprises, and insurers to improve underwriting, increase coverage, and strengthen supply chain resilience.

Real-world results

Insurance work gets done on the network

4X Increase in supply chain disruption coverage limits unlocked for enterprises with verified Tier 2 and Tier 3 visibility

65% Of suppliers surfaced risks in their own networks, enabling proactive action and preserving insurability

75%+ Of placement gaps closed by replacing assumptions with verified, network-sourced supply chain data

A network solution

Enabling right-sized coverage, improved underwriting, and multi-faceted risk mitigation strategies.

Improve understanding of supply chain resilience and realize enhanced CBI/CTE coverage terms by targeting specific risks and demonstrating proactive risk management.

Importers

Improve risk analysis with multi-tier supply chain visibility and traceability to position clients for better placement outcomes.

Brokers

Secure coverage and support buyer placements by demonstrating operational resilience, increasing transparency, reducing exposure uncertainty, and simplifying risk assessments.

Suppliers

Improve underwriting processes and price supply chain risk more accurately. Improve limit setting, reduce blind spots, see and manage cross liabilities, and more strategic use of reinsurance.

Insurance carriers

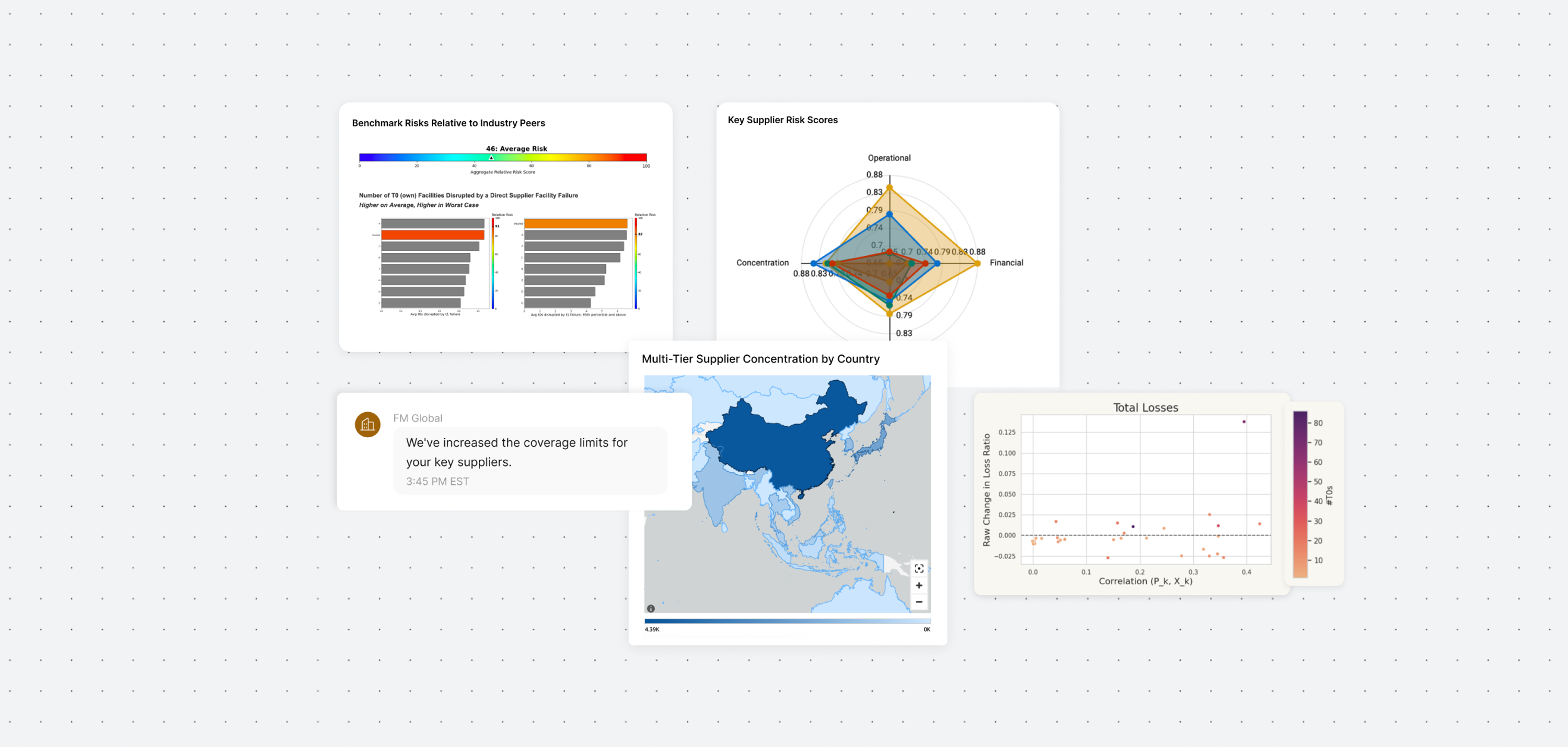

Supplier risk insights

Find single-sourced suppliers and potential bottlenecks deep in your network that could cause major disruptions and adversely affect insurability.

Geographic vulnerability indicator

See where critical materials flow through high-risk countries or areas with natural hazard exposures so you can mitigate disruption risks.

Resilience reporting

Show insurers a clear, data-backed view of your network's strength to justify higher coverage and better terms.

CBI insurance insights

Provide complete and credible data to make getting CBI and TDI coverage smoother.

Business impact analysis

Assess financial impacts of risk to guide strategic decisions on risk management and transfer.