The U.S. defense industrial base is heavily dependent on foreign components and natural resources, Altana’s analysis of global supply chain data shows, leaving defense contractors liable for steep national security tariffs and the Pentagon at risk of critical minerals shortages.

An analysis from Altana’s Product Network, which is built on the world’s largest, most accurate picture of the global supply chain, reveals extensive dependence within U.S. defense industrial base (DIB) product value chains on foreign inputs. This reliance leaves billions of dollars of annual imports exposed to China’s bans on exports of critical minerals, as well potential Section 232 national security tariffs, pending the resolution of U.S. Department of Commerce investigations into processed critical minerals, semiconductors, drones and drone components, polysilicon, and their derivative products. The Ukraine War and the administration’s inconsistent support for Kyiv has spurred Europe to boost its own defense spending, including on U.S. defense articles. Growing great power competition between the U.S. and China has boosted U.S. defense spending in the Indo-Pacific region. And the rapidly evolving nature of war has sparked huge demand for new defense applications such as UAVs and autonomous surface vessels, space-based missile warning and interceptor systems, and smart ammunition and precision-guided artillery munitions.

Learn more about the resilience and tariff challenges within the U.S. defense industrial base, and see how Altana's Product Network offers defense contractors and the Department of Defense a shared source of visibility, traceability, and collaboration to secure the most vital value defense chains and ensure operational readiness for warfighters.

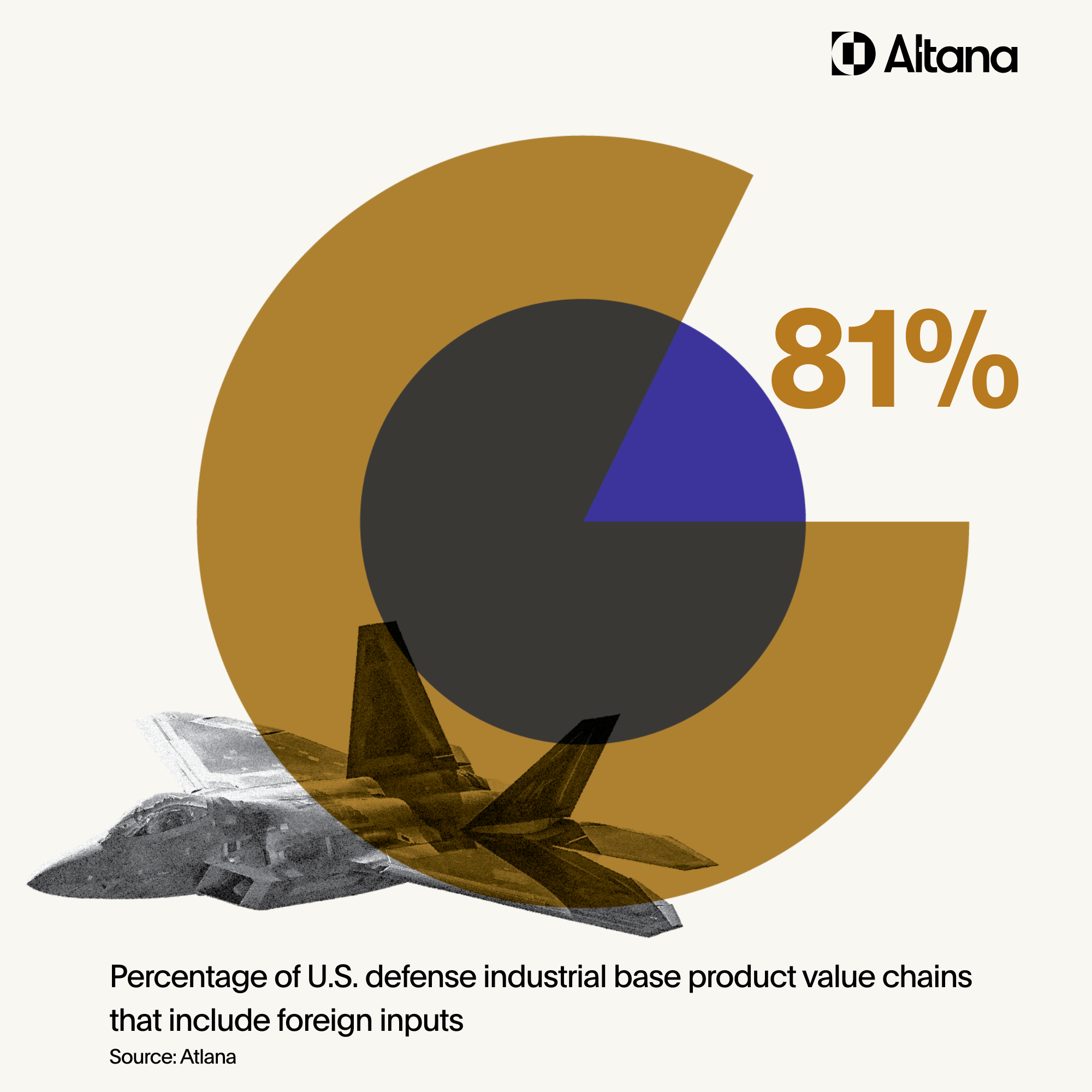

Defense primes’ value chains rely on foreign inputs; more than 81% of DIB value chains have foreign suppliers upstream

Altana’s analysis reveals that in 2024, 584,415 U.S. defense prime product value chains had non-U.S. or Canadian inputs present upstream. This number made up 81% of the U.S. DIB value chains analyzed, demonstrating vast reliance on foreign manufacturing and components.

A significant amount of content in U.S. defense value chains comes from China — roughly half of all foreign reliance. About 273,000 of the analyzed value chains containing foreign transactions had Chinese inputs at Tier 3 in the value chain. Chinese upstream exposure spans defense components and applications, with significant chokepoints in the critical minerals and permanent magnets necessary to produce motors, sensors, infrared, batteries, nuclear fuel, and more. Previous Altana research has demonstrated that many of the upstream Chinese inputs in DIB supply chains come from military entities flagged under NDAA Section 1260H, which in 2027 will prohibit the DoD from entering into contracts in which the flagged entities are present anywhere upstream in value chains. That imperils contractors’ ability to contract with the DoD. The remainder of the upstream foreign reliance in U.S. defense value chains is spread among countries that boast advanced defense industries:

- Mexico (34,632 value chains with upstream exposure) is a major producer of aerospace components, including complex parts for aircraft engines, fuselages, sensors, and specialized structures.

- India (27,596 value chains with upstream exposure) has developed ammunition and missile system manufacturing sectors.

- Malaysia (17,421 value chains with upstream exposure) has a growing electronics manufacturing sector that contributes to U.S. defense value chains, with components for radar, communications, optronics, and electronic warfare coming from Malaysian suppliers.

- Germany (11,335 value chains with upstream exposure) has a developed defense sector specializing in high-tech engine, suspension system, and armor components for battle tanks and other land vehicles.

- Taiwan (7,900 value chains with upstream exposure) is the global leader in semiconductor manufacturing, which have dual-use capabilities as military-grade computer chips for missile guidance systems, radars, command and control systems, and other high-tech defense components.

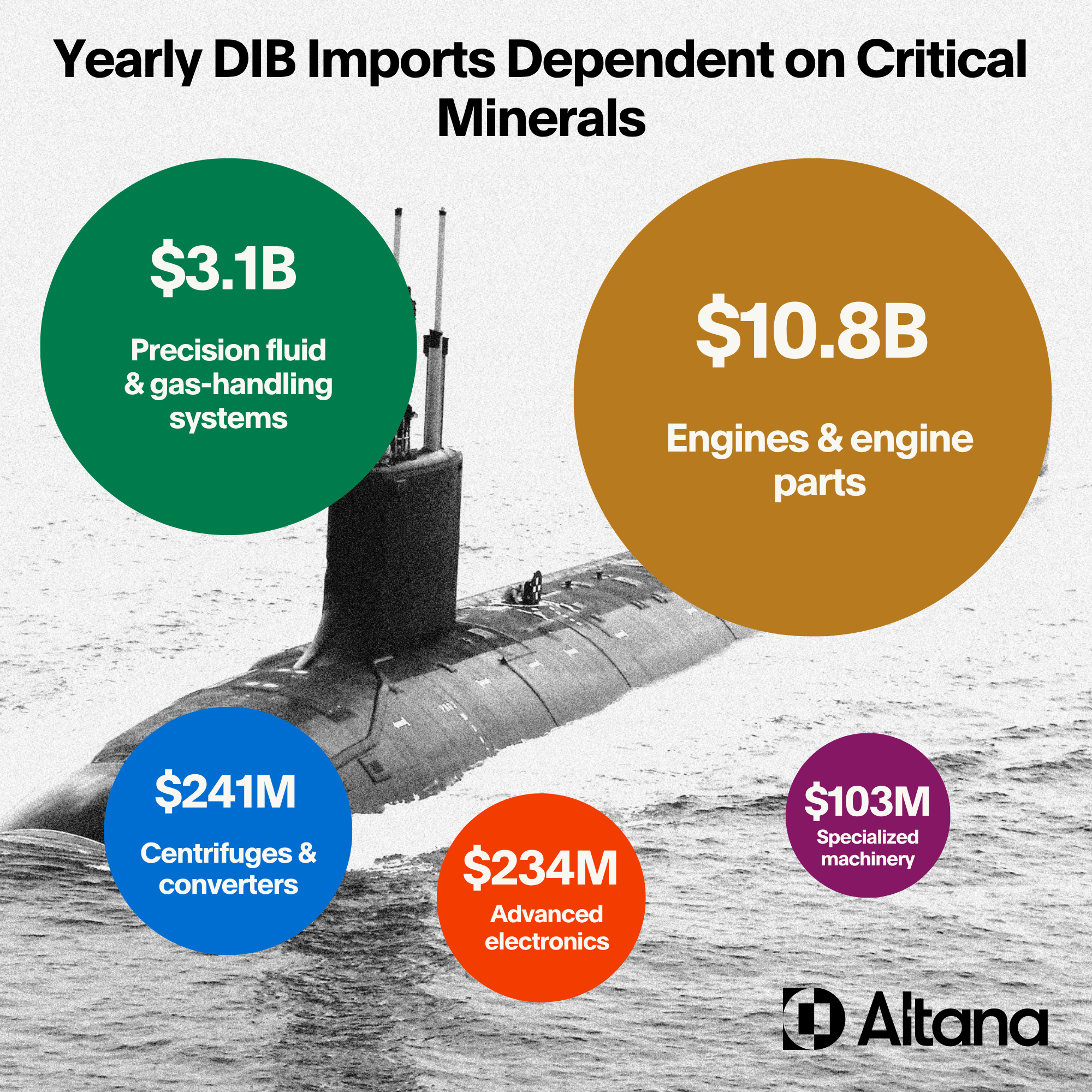

China export controls on critical minerals, U.S. Section 232 tariff investigations expose $14B+ of yearly DIB imports to further disruption

Altana’s analysis indicates that reliance on imports threatens the security of DIB supply chains and could introduce significant exposure to component-based tariffs. China has imposed export controls on critical minerals and magnets, while the U.S. Department of Commerce has launched Section 232 investigations into critical minerals and semiconductors. In 2024, $14.2 billion of U.S. defense contractor imports included critical minerals in their product value chains, the analysis reveals. Some of these were of finished parts such as internal combustion engines or converters; others were sub-components necessary for these applications, such as lithium-ion accumulators or heat exchange units built for extreme environments.

The categories of DIB imports containing rare earth metals and minerals include:

- Internal combustion engines and engine parts ($10.8 billion of annual imports), which rely on rare earth elements and permanent magnets, especially dysprosium, samarium, and tungsten

- Precision fluid & gas handling systems ($3.1 billion), which use gadolinium, lutetium, and more for sensors and actuators

- Centrifuges and converters ($241 million), which need neodymium and dysprosium for electric motors

- Advanced electronics and components ($234 million) and other specialized machinery ($103 million), which use a range of critical minerals for electronic circuits, hardness, thermal stability, and more

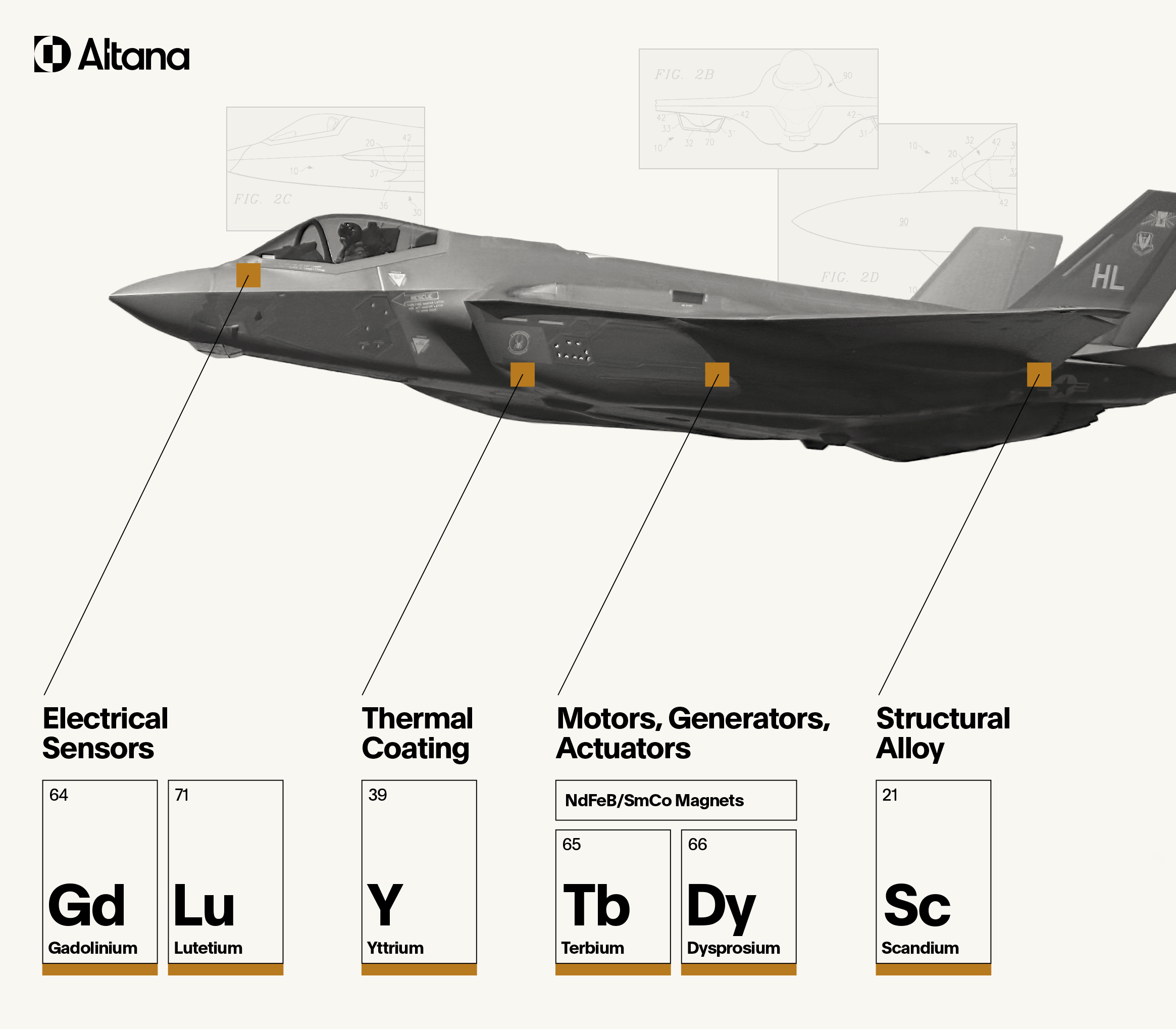

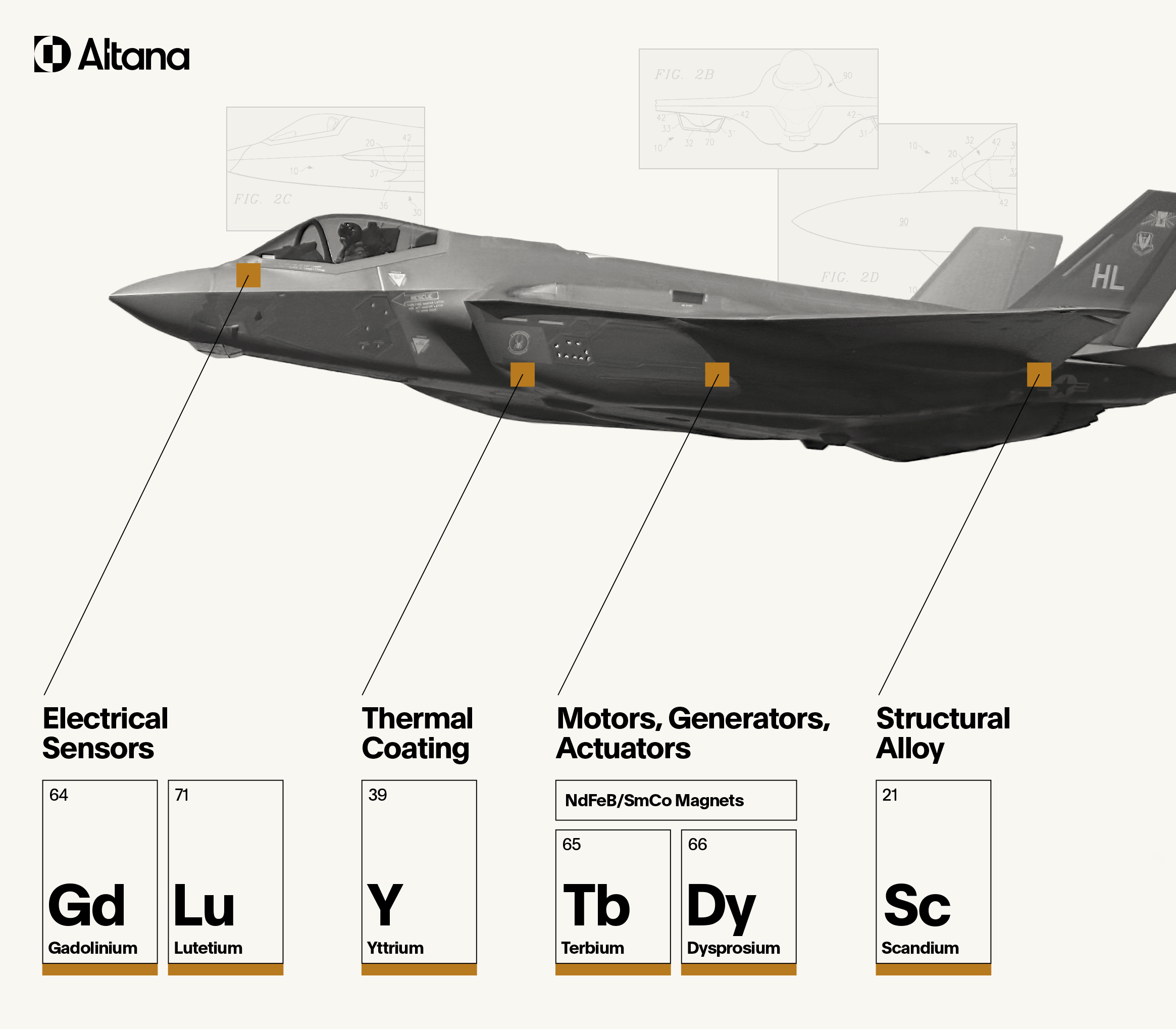

China controls most of the world’s critical metals and minerals refinement and more than 90% of the refinement of rare earth metals necessary for defense products. The upshot: A finished defense application such as the F-35 Joint Strike Fighter needs rare earth minerals for electrical sensors, structural alloys and other components subject to China’s export controls and restrictions.

As U.S. buyers of rare earth minerals begin identifying alternative trade lanes and sourcing opportunities to bypass Chinese export restrictions, the defense base has another looming challenge: Section 232 investigations, a formal inquiry conducted by the U.S. Department of Commerce to determine if the quantity or circumstances of imports of a particular article threaten to impair U.S. national security. Launched in April 2025 into foreign critical minerals and semiconductors and July 2025 into drones, drone components, and polysilicon, these investigations could lead to higher tariffs on inputs and components vital to defense supply chains. Section 232 tariffs enable the U.S. president to apply sectoral tariffs on imported articles and their derivative items. Current Section 232 national security tariffs on steel and aluminum apply 25% levies on raw steel and aluminum, derivative components such tubes, pipe fittings, and ropes and cable, and finished products with steel and aluminum content, such as refrigerators, dishwashing machines, and stoves. For finished products, importers must pay a levy on the declared value of steel and aluminum content. Similar rules for critical minerals, semiconductors, drones, and polysilicon could cause tariff rates for DIB imports to skyrocket. As with critical minerals, myriad components within defense articles rely on semiconductors and polysilicon. Drones, often referred to as Uncrewed Aircraft Systems, are considered vital to the present and future of warfare.

Allied defense contractors need to ask:

- If the administration does impose national security tariffs, will the defense industry receive exemptions?

- Will imports of specific defense applications or components be subject to a form of percentage-based levies on semiconductors, polysilicon, and critical minerals content?

- And how will quantifying and mitigating exposure to a complex swirl of levies, export controls, and other resilience risks be possible with so much of the exposure present upstream, in Tier 2, 3, and beyond in value chains?

Bolster resilience and achieve visibility, traceability and collaboration in defense value chains on Altana’s Product Network

Unlike tired supply chain technology that requires burdensome and inaccurate manual mapping, risk screening tools, and supplier surveys, Altana’s Product Network makes it possible for:

- DIB primes, contractors, and sub-contractors to illuminate, design and collaborate across product-level value chains to identify and mitigate resilience challenges, manage costs, and source secure suppliers.

- the Department of Defense (DoD) to assess vital DIB products for vulnerabilities from the point of acquisition, and then to partner with the DIB to secure value chains and build sustainable, scalable programs and supply chains that ensure operational readiness for warfighters.

Altana’s Product Network offers these benefits through visibility, traceability, and collaboration:

- Visibility means getting an instant, dynamic map of N-tier relationships at a product level. AI reveals specific multi-tier product value chain connections and uncovers relationships and risks, such as upstream exposure to an adversarial supplier of critical minerals.

- Traceability means having detailed data and documentation on a product’s lifecycle, as verified by upstream suppliers, to confirm where critical dependencies exist.

- Collaboration means closer relationships and real-time communication with government agencies and regulators. Altana Product Passports enable collaboration with upstream and downstream supply chain partners, allowing DIB contractors and sub-contractors to work directly with DoD to validate compliance, stress test resilience, identify alternative suppliers, and design secure value chains. The DoD can collaborate with DIB contractors and sub-contractors to model scenarios, make strategic investments, propose alternative suppliers, and ensure operational readiness for every defense program.